ABC 30 investigation finds dangerous

recalled cars for sale on dealer lots

Channel 30 (ABC) Fresno

November 17, 2014

by Corin Hoggard

"A record number of vehicles are getting recalled this year. Car makers have pulled about one of every five vehicles on the road, 58 million of them. But many of the potentially dangerous cars are hiding in plain sight on used car lots here in the Valley.

The truth is: they're all over the place, and you may never know it until it's too late."

See video:

ABC 30 News investigation finds dangerous recalled cars on dealer lots

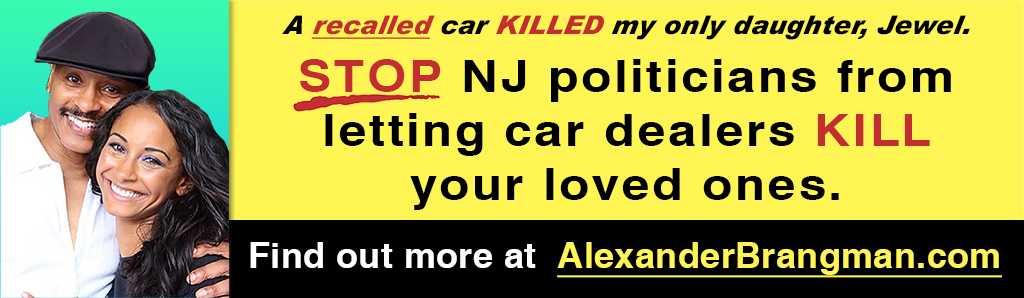

CarMax -- caught on Camera AGAIN selling unsafe, recalled cars

An undercover investigation by WSB-TV in Atlanta, GA found CarMax is still selling unsafe, recalled cars -- while claiming they take care of safety recalls.

Instead of cleaning up their act, and ensuring the cars they sell are safe, CarMax says they plan to keep leaving it up to car buyers to get the safety recall repairs done -- AFTER they buy the car. For millions of recalled cars, it could take months before repair parts are available, and meanwhile CarMax customers will be stuck driving ticking time bombs.

Watch video:

WSB-TV report: CarMax under Fire over Recall Policy

Advocates call for national Takata air bag recall

USA Today

October 23, 2014

by Chris Woodyard

"As the government issued urgent warnings about Takata air bags, safety activists and a couple of U.S. senators questioned whether millions of other drivers have been left in danger.

That's because the recalls and free repairs by 10 automakers for the potentially deadly air bags are regional, applying only to cars sold or registered in humid areas such as Florida and the Gulf Coast.

On Monday, National Highway Traffic Safety Administration said owners of the cars in Hawaii, Florida and several U.S. territories were at greatest risk. When the notice was expanded Wednesday, the agency added in Texas, Alabama, Mississippi, Georgia, Louisiana, a total of 7.78 million....

A safety activist also pointed out that where a car is registered and where it spends substantial amounts of time may be different. "Cars move, people move and it doesn't make sense to assume the car will stay in the same place," says Rosemary Shahan, president of Consumers for Auto Reliability and Safety in Sacramento, Calif. "We are a very mobile society. You have all these snowbirds that go to winter in Florida."

Although most cars equipped with Takata air bags have been under recall for months or even years, the government's warning this week stemmed from tests that showed the passenger side air bag inflators were particularly prone to failure -- causing the bags to spew metal and plastic debris like shrapnel when they deploy -- in very humid climates."

Read more:

USA Today: Advocates call for national Takata air bag recall

Massachusetts Dept. of Transportation Guardrail Replacement Program Faulted

The Boston Herald

October 22, 2014

by Marie Szaniszlo

"The state Department of Transportation is waiting for crashes or other damage to replace caps on the ends of guardrails on many state roads, a spokesman said, even as federal officials are ordering new tests in the wake of a lawsuit that questioned their safety....

Critics say the caps, manufactured by Dallas-based Trinity Highway Products, can cause the tips of guardrails to impale cars, rather than collapsing and cushioning the impact when hit head-on....

Rosemary Shahan, founder of Consumers for Auto Reliability and Safety, said that while MassDOT deserves credit for its moratorium on further installations of ET-Plus parts, it should also be taking steps to ensure that existing caps are safe. 'The fact that (ET-Plus caps) are commonly in use across the country doesn’t make them safe,' Shahan said."

Read more:

Boston Herald: MA Guardrail Replacement Faulted

CarMax Under Fire for Selling Recalled Cars

Call Kurtis Investigates

KOVR-TV (CBS) Channel 13, Sacramento

September 30, 2014

By Kurtis Ming

Angela Davidson says she was sold when the CarMax sales associate told her the 2010 Dodge Ram she was looking to buy passed the company's 125+ point inspection. Days later, when she called Dodge for help pairing her cellphone to the truck, she was surprised to learn it had an unfixed recall over a rear axle issue.

See full report:

KOVR-TV: CarMax Under Fire for Selling Recalled Cars

Protesters Urge CarMax to Stop Selling

Recalled Cars

FOX-TV Channel 40, Sacramento

September 30, 2014

By Zhoreen Adamjee

Under current federal law, it's illegal to sell new cars if they're recalled. But when it comes to used cars, it's legal.....Davidson is still frustrated that CarMax sold her a recalled vehicle. When she bought the car, she said she didn't know Chrysler had issued a safety recall on the car last year for an issue with the rear axle. She says she wouldn't have bought the car had she known. 'They led us to believe that this truck was safe, when it wasn't. They let us drive off the lot with an open recall on it,' Davidson said.

See full report:

FOX-40 : Protesters Urge CarMax to Stop Selling Recalled Cars

U.S. Auto Sales Seeing Big Surge

The Sacramento Bee / McClatchy Washington Bureau

August 28, 2014

by Kevin G. Hall

"Four-year car loans used to be the norm, which then became five-year loans. From April through June of this year, 41 percent of new-car loans were for financing largely about six years, according to data from the credit analysis firm Experian.

About 14 percent of used car loans were for periods between six and seven years, the Experian data shows.

“A lot of times the car dies long before they can pay off the loan, or there is an expensive repair that they can’t afford, so they trade it in,” said Rosemary Shahan, the president of the California-based consumer advocacy group Consumers for Auto Reliability and Safety.

“The loans are disproportionate to the value of the car. The car is a depreciating asset, and it is going to be worth even less as time goes on, and that negative equity gets rolled into the next loan.”

The long-term loans could result in snowballing debt."

Read more:

Sacramento Bee: U.S. Auto sales seeing big surge

How to Check if Your Car Was Recalled

But Not Fixed

Los Angeles Times

August 20, 2014

By Jerry Hirsch

"Car owners and buyers will be able to look up whether a vehicle has been recalled and fixed under a new federal program launched late Tuesday.

The National Highway Traffic Safety Administration has developed an online search tool where drivers can find out if a specific car has been recalled and why. The car companies will have to provide at least 15 years of data for the tool, at

http://www.safercar.gov, and update their information every seven days....

"I am encouraging consumers to check it out before they buy a used car from anybody - a private party or a dealer," Shahan said. But the program has gaps that will continue to keep unrepaired cars on the road, she said. The information is only in English and it is only available online, she noted. If people speak a different language or don't have a computer or smartphone, they won't be able to research a car's recall history."

Read more:

Los Angeles Times: How to Check if Your Car Was Recalled But Not Fixed

Regulators Fine Hyundai $17.4 Million After It Is Slow to Report Defect

New York Times

August 7, 2014

By Danielle Ivory

Christopher Jensen contributed to this report

"Federal auto regulators on Thursday imposed a nearly $17.4 million penalty on Hyundai because it did not promptly report to the public a safety defect that affected braking in its cars.

Sometime in 2012, Hyundai was informed that the brake fluid used in some Genesis cars from the 2009-12 model years would not sufficiently inhibit corrosion and might cause the brakes to stop working properly. Yet Hyundai did not recall the vehicles until October 2013....

"Hyundai failed to act to protect their customers and others that were harmed in an accident, and must change the way they deal with all safety-related defects," said David J. Friedman, the agency’s acting administrator...

As part of its agreement with the safety agency, Hyundai will make changes to its safety practices, including allowing its American unit to make decisions about recalls without approval from the parent company in South Korea.

Rosemary Shahan, president of Consumers for Auto Reliability and Safety, said that provision may be a result of regulators being "under more scrutiny than ever before," but that it was a welcome surprise.

"I hope it’s a trend," she said."

Read more:

New York Times: "Regulators Fine Hyundai $17.4 million After It is Slow to Report Defect"

GM Resists Expanding Victims' Fund

New York Times

July 19, 2014

By Danielle Ivory and Rebecca R. Ruiz

"The cars are different, but the circumstances surrounding their recall are strikingly similar. The ignition switch would suddenly shut off, drivers complained...GM then quietly fixed the switch, without removing the faulty parts from circulation. And for more than a decade there was no recall. Yet GM maintains that a distinct difference exists between its recall of 2.6 million older Chevrolet Cobalts and other cars, which started in February, and its more recent recall of 7.6 million cars like the Chevrolet Malibu... it has refused to expand a fund set up to compensate victims of the defective Cobalts -- infuriating safety advocates....

Rosemary Shahan, president of Consumers for Auto Reliability and Safety, an advocacy group, saw little difference. 'The basic problem is that G.M. made a lot of ignitions that make cars prone to die in traffic, and that’s dangerous,” she said. As for the compensation program, she said: “It should cover everybody injured by a G.M. product. Why is it limited now, just because this is a defect with the most notoriety? Where’s the justice in that?' "

Read more:

NY Times: GM Resists expanding victims fund

Honda Asking Buyers to Sign Liability Document

AOL Autos

July 31, 2014

By Pete Bigelow

Honda "recently started disclosing possible recalls related to airbag malfunctions in certain vehicles. Honda is asking customers buying those used cars to sign a document that acknowledges they've been made aware of the issue. Buyers may be better informed, but such a signature could also shift liability away from the automaker....Starting in 2001, several automakers have issued more than 20 separate recalls for millions of these airbags, which are manufactured by global supplier Takata. Exploding airbags are responsible for at least two deaths in the US, and scores of injuries....

"I think this form of disclosure is probably worse than nothing," said Rosemary Shahan, president of Consumers for Auto Reliability and Safety. "They're taking advantage of the fact the consumer doesn't expect a Honda dealer to hook them into such a risky car. ... The reality is that it will be in a stack of papers that a customer is signing hours into the buying process."

Read more:

AOL Autos Honda asking buyers to sign liability document

Used Cars Are The Next Front In The War Over Recall Repairs

Forbes

July 31, 2014

By Jim Henry

With a record number of recalls in the headlines, led by the

General Motors ignition switch recalls, the

New York City Department of Consumer Affairs took it upon itself to enforce a city statute the city interprets as a ban on selling used cars that are subject to a recall without performing the recall work. “More cars have been recalled in 2014 than any other year on record,” said

Commissioner Julie Menin of the Consumer Affairs Department, in a written statement earlier this week. “We’re not going to wait for tragic statistics to demand that dealers repair these ticking time bombs,” she said. The city this week announced it sent subpoenas to 200 used-car dealerships, around 25 percent of all dealers in New York City....

New Yorkers are not alone in worrying whether recall repair work actually gets accomplished, and who’s responsible for making sure it does. The question is also at the top of the agenda this year for other public- and private-sector consumer advocacy groups around the country, such as

Consumers for Auto Reliability and Safety, Sacramento, Calif., according to Rosemary Shahan, president. CARS is petitioning regulators like the

Federal Trade Commission to prohibit retailers from selling used cars without performing recall-related work.

Read more:

Forbes - Used Cars Are The Next Front In The War Over Recall Repairs

GM backs revised bill to bar use of

unrepaired recalled rental cars

Detroit News

July 16, 2014

By David Shepardson

Washington - General Motors Co. said Wednesday it will back legislation that will require rental car companies to repair recalled rental cars before they are sold or rented — becoming the first automaker to do so.

The Detroit automaker told Sen. Charles Schumer, D-N.Y., in a letter that it would back legislation - which has won the support of major rental car companies — if it won minor changes.

"When buying or renting a car, the last thing we should worry about is if the car is defective or recalled,” Schumer said. “I thank General Motors for endorsing our common sense legislation and hope it opens the door for more car manufacturers to do the right thing and support our bill to keep consumers safe.”

Read more:

Detroit News: GM backs rental car safety bill

GM Endorses Bill Named After Sisters Killed In Rental Car Crash - Raechel and Jacqueline Houck Safe Rental Car Act Gains Support

KEYT - KCOY - KKFX- TV Santa Barbara, CA

by Tracy Lehr

GM joins rental car companies, Cally Houck, CARS, and our consumer group allies in supporting the Raechel and Jacqueline Houck Rental Car Safety Act

"

OJAI, Calif. - General Motors announced its endorsement of a rental car safety act that is named after the daughters of an Ojai lawyer.

Cally Houck's daughters Raechel and Jacqueline Houck died in a rental car that crashed on the 101 freeway nearly 10 years ago.

The Chrysler PT Cruiser had a power steering defect. Enterprise paid the family $15 million [after a trial in court].

But the family is still fighting [ever since], for a bill to prevent rental car companies from renting or selling recalled cars.

Houck said she was pleased by GM and hope other car makers will do the right thing on behalf of consumers."

See video:

KEYT-TV - KCOY - KKFX-TV report: GM Supports Rental Car Safety Act

11 Consumer Groups ask F.T.C. to Investigate CarMax over Unfixed Recalled Cars

New York Times

June 24, 2014

By Christopher Jensen

"Saying that advertisements by CarMax, the nation’s largest used-car retailer, are deceptive, a coalition of 11 consumer groups has asked the Federal Trade Commission to investigate.

Rosemary Shahan, the president of Consumers for Auto Reliability and Safety, said the groups would like the F.T.C. to stop CarMax from selling used vehicles without fixing recalls. “They are trying to say they are not responsible for making sure the recall work is done at the time you buy the car,” she said.

The CarMax-related petition being sent to the F.T.C. also has the support of Senator Charles E. Schumer, Democrat of New York. “It is bad enough that used-car dealers are not required by law to fix a safety recall problem prior to selling the recalled vehicle to a consumer,” Senator Schumer wrote in a supporting letter sent to the F.T.C. on Monday. “Compounding the safety risks with misleading and deceptive advertising and sales practices only further endangers the safety of used-car customers and everyone who shares the roads,” he wrote.

The lack of a law requiring recall repairs to be performed on used vehicles surprised Angela Davidson, who bought a 2010 Ram 1500 pickup from a CarMax dealer in Irvine, Calif., last month. She contacted Chrysler to see about using Bluetooth to connect her cellphone. After providing the vehicle identification number, she was told that her Ram had been recalled in February 2013 because

the rear axle might seize up. Chrysler had told federal safety regulators that such a development could “cause a loss of vehicle control and/or a vehicle crash with little warning.”

“If I had known that there was an open recall like that there is no way on this Earth that I would have driven off with that truck,” she said."

Read more:

New York Times: Consumer Groups Ask FTC to Investigate CarMax

Petition Seeks to Block CarMax Sales of Unrepaired Recalled Cars

Los Angeles Times

June 24, 2014

By Jerry Hirsch

“CarMax is playing recalled-used-car roulette with its customers' lives,” said Rosemary Shahan, president of Consumers for Auto Reliability and Safety, a Sacramento consumer advocacy nonprofit that spearheaded the petition.

.... attorneys for CarMax said it was impractical for the used car seller to manage the repairs, with the company having to devote staff time to taking a recalled car to the nearest dealer of that make for the repairs. The manufacturer, not CarMax, would still pay for all recall repairs."

Read more:

LA Times: Petition Seeks to Block CarMax Sales of Unrepaired Recalled Cars

Safety Groups Urge FTC to Halt CarMax Advertising

over Unrepaired Recalled Vehicles

Detroit News

June 24, 2014

By David Shephardson

"Washington— A dozen auto safety and consumer groups asked the Federal Trade Commission to stop the nation’s largest used-car seller, CarMax Inc., from advertising its vehicles as rigorously inspected when it fails to complete recall repairs before selling the vehicles.

At issue in the FTC petition is the company’s advertising as “CarMax Quality Certified” with a rigorous “125+ point inspection.” The four-page petition calls it “inherently deceptive” to tell customers that vehicles have passed a rigorous safety inspection, “while failing to take even the most basic step of checking the vehicle’s safety recall status.”

Read more:

Detroit News: Safety Groups Urge FTC to Halt CarMax Ads over Recalled Cars

Consumer, Safety Groups Seek FTC Probe of CarMax

Wall Street Journal

June 24, 2014

By Tess Stynes

"Consumer and safety groups are urging the Federal Trade Commission to investigate their allegations that used-vehicle retailer CarMax Inc. is failing to check the safety-recall status of the vehicles it sells."

"CarMax is playing recalled used-car roulette with its customers' lives," said Rosemary Shahan, president of Consumers for Auto...

Read more:

Wall Street Journal: Consumer, Safety Groups seek FTC Probe of CarMax

Consumer Groups Warn CarMax Has Misleading Ads

WFMY News Channel 2 (Gannett)

By Benjamin Briscoe

"GREENSBORO, N.C. - If a used car dealer told you it put every vehicle through a "rigorous inspection" and "thorough reconditioning process" - would you expect the car you buy to still have problems? Problems that could lead to an engine fire or the brakes failing?

The engine fire and brake failure problems are real open recalls 2 Wants To Know found in CarMax's Triad stock. And those claims about "inspection" and "reconditioning" are from a CarMax commercial."

See video:

WFMY News: Consumer Groups Warn CarMax Has Misleading Ads

Recalled Used Cars Roam the Roads as Federal Legislation Stalls

New York Times

Front page

May 8, 2014

By Rachel Abrams and Christopher Jensen

Matthew Wald contributed to this report

"David Clayton was driving 70 miles an hour in his Ram 1500 pickup truck last October when he learned the hard way that it had a serious safety problem. The rear axle locked up, causing him to nearly lose control before wrestling the truck to the side of the highway. Chrysler knew about the axle defect, and had ordered a recall of the pickup before Mr. Clayton bought it used last July from a dealer in Visalia, Calif. But the dealer never had the axle repaired — and was not required to do so under the law."

"It should be a slam dunk," David J. Friedman, acting administrator of the National Highway Traffic Safety Administration, said of required repairs. "To me it is hard to oppose ensuring that people who buy a car, whether it is new or used, or whether you are renting a vehicle, can have the confidence that it is safe.''

....

"It’s just a question of how long it will take and how many people have to be killed or injured before it happens," said Rosemary Shahan, the president of Consumers for Auto Reliability and Safety, an advocacy group pushing for legislation."

CARS note: David Clayton bought his pickup truck from a Dodge - Chrysler - Jeep new car dealership that sold it to him as a "Factory-Backed Certified" vehicle that had undergone a rigorous 125-point inspection, and handed him a checklist that checked off "perform outstanding vehicle campaigns."

Read more: New York Times:

"Recalled Used Cars Roam the Roads" May 8, 2014

Sen. Boxer urges

General Motors CEO Mary Barra

to support Rental Car Safety Legislation

GM is Part of Industry Trade Group Lobbying to Block Legislation to Protect Consumers from

Unsafe, Recalled Rental Cars

Washington, D.C. – U.S. Senator Barbara Boxer (D-CA) today sent a letter urging General Motors CEO Mary Barra to support the Raechel and Jacqueline Houck Safe Rental Car Act, bipartisan legislation that would help protect consumers by keeping unsafe, recalled rental cars off the road.

Last week, at a Senate Commerce Subcommittee hearing on GM’s recall of 2.6 million vehicles, Senator Boxer

questioned Barra about GM’s troubling opposition to the legislation – through the industry trade group, the Alliance of Automobile Manufacturers – in light of the company’s promise to cover the cost of interim rental vehicles while customers wait for their vehicles to be repaired. Barra agreed at the hearing to take a closer look at the legislation.

Senator Boxer wrote,

“Your support for this bill is critical because right now there is no guarantee that your customers are renting safe cars while they wait for their recalled vehicles to be repaired.”

Senator Boxer

introduced the legislation with Senators Claire McCaskill (D-MO), Charles Schumer (D-NY) and Lisa Murkowski (R-AK) after two of Boxer’s constituents – Raechel and Jacqueline Houck, two sisters from Santa Cruz – were killed in a tragic accident in 2004 while driving a rented Chrysler PT Cruiser that had been recalled for a power steering hose defect but had not been repaired. The car caught fire because of the defect while traveling on Highway 101 in Monterey County, causing a loss of steering and a head-on collision with a semi-trailer truck.

In September 2012, Senators Boxer, Schumer and McCaskill

announced that all major car rental companies – Hertz, Enterprise, Avis Budget, Dollar Thrifty, and National – agreed to voluntarily stop the renting or selling of vehicles that have been recalled by their manufacturer and endorsed the legislation.

Although the bipartisan bill has the support of the major rental car companies and consumer advocates, the Alliance of Automobile Manufacturers – which includes GM – has opposed the bill and is working to prevent it from moving forward in the Senate. The National Automobile Dealers Association, which includes many GM franchise dealerships, is also opposed to the legislation.

“You testified that ‘When there’s a safety issue, there should never be a business consideration that goes against it’,” Senator Boxer continued.

“I hope you will take this to heart as you review this legislation.”

The legislation is also endorsed by American Car Rental Association, Consumers for Auto Reliability and Safety, AAA, Advocates for Highway and Auto Safety, Consumers Union, and State Farm Insurance. The bill also has the support of Cally Houck, the mother of Raechel and Jacqueline Houck.

The full text of the letter follows:

April 8, 2014

Mary T. Barra, Chief Executive Officer

General Motors Company

P.O. Box 33170

Detroit, MI 48232-5170

Dear Ms. Barra:

During your testimony before the Senate Commerce Subcommittee on Consumer Protection, Product Safety, and Insurance, you stated that you had not read S. 921, the Raechel and Jacqueline Houck Safe Rental Car Act, which is named after two sisters from Santa Cruz who were killed when a recalled car they had rented caught fire and crashed into a truck.

This legislation, which was first introduced in 2012, would:

Prohibit the rental or sale of rental vehicles subject to a federal safety recall, consistent with existing law for new car dealers, who are prohibited from selling or leasing recalled vehicles.

Require rental companies to ground vehicles within 24 hours of receiving a safety recall notice from the manufacturer. Companies with fleets over 5,000 vehicles would have up to 48 hours.

Permit rental companies to implement temporary measures to eliminate the safety risk until parts are available.

Allow manufacturers to continue to issue technical service bulletins or customer satisfaction service campaigns for problems that do not rise to the level of a federal safety recall.

Your support for this bill is critical because right now there is no guarantee that your customers are renting safe cars while they wait for their recalled vehicles to be repaired.

You testified that “When there’s a safety issue, there should never be a business consideration that goes against it.” I hope you will take this to heart as you review this legislation.

Sincerely,

Barbara Boxer

United States Senator

Wisconsin "Lemon Law King" sues Tesla

San Jose Mercury News

April 7, 2014

Attorney Vince Megna filed the Wisconsin lawsuit in Milwaukee County Circuit Court. He said he believes the lawsuit is the first lemon law claim against Tesla anywhere in the country. Rosemary Shahan, president of Consumers for Auto Reliability and Safety, a national nonprofit car safety and consumer advocacy organization, said she hasn't heard of any other similar lawsuits against the Palo Alto-based company.

"I would guess for the most part they're taking pretty good care of these customers," Shahan said of Tesla. "They have a lot of reason to keep them happy. High-end customers tend to get treated differently ... why did they let it get to this point where they had to file a lawsuit?"

Read more:

San Jose Mercury News: Wisconsin "Lemon law king" sues Tesla

General Motors under fire for fatal defects

Uprising Radio

April 3, 2014

Hear the interview with Uprising Radio host Sonali Kolhatkar

CA Senator Barbara Boxer

challenges GM CEO Mary Barra:

Stop opposing federal rental car / safety recall bill

Barra claims GM no longer places top priority on costs, at the expense of its customers' safety. But the sole reason that GM and the Auto Alliance give for opposing the Raechel and Jacqueline Houck Rental Car Safety Act? They don't want to face having to pay rental car companies for lost revenue if they have to ground vehicles that are under a safety recall, pending repairs. Apparently GM anticipates making a lot more unsafe vehicles that will be subject to safety recalls. Hardly reassuring.

BOXER PRESSES GENERAL MOTORS CEO MARY BARRA ON RENTAL CAR SAFETY

Senator Asks Why GM Is Part of Industry Effort to Block Legislation to Protect Consumers from Unsafe, Recalled Rental Cars – While at the Same Time Placing Owners of Its Own Recalled Cars into Rental Vehicles

Washington, D.C. – U.S. Senator Barbara Boxer (D-CA) today questioned General Motors CEO Mary Barra on rental car safety at a Senate Commerce Subcommittee hearing on GM’s recall of 2.6 million vehicles. Senator Boxer asked Barra to explain GM’s opposition – through the industry trade group, the Alliance of Automobile Manufacturers – to the Raechel and Jacqueline Houck Safe Rental Car Act, which would protect consumers from unsafe rental vehicles under recall – at the same time that GM is placing owners of its own recalled vehicles into rental cars.

To view the video of Senator Boxer’s exchange with Barra on her official website, please click

here.

“Do you support a proposed law by Senator McCaskill and myself that would say recalled cars like yours can no longer be rented or loaned?” Senator Boxer asked.

After Barra refused to commit to supporting the bill, Senator Boxer responded:

“Now you should know that my constituent Cally Houck lost her two daughters, Raechel, 24, and Jacquie, 20, in a tragic accident caused by an unrepaired safety defect in a rental car they were driving. So [with] Senator Schumer and McCaskill, we wrote the Raechel and Jacqueline Houck Safe Rental Car Act. And you know what, the rental car people support it, but you don’t. The automobile manufacturers don’t. So you are essentially bragging today, if I may use the word, that you’re telling your people to get another car, but at the same time your lobbying organization is opposing a bill that would make sure no one would die the way they died.”

While current law prohibits car dealerships from selling new vehicles under recall to consumers, no law bans rental car companies from doing the same or renting them to unsuspecting consumers. The

Raechel and Jacqueline Houck Safe Rental Car Act – sponsored by Senator Boxer and Senators Claire McCaskill (D-MO), Charles Schumer (D-NY) and Lisa Murkowski (R-AK) – would keep unsafe rental cars that have been recalled off the road.

The bipartisan bill is named in honor of Raechel and Jacqueline Houck, two sisters from Santa Cruz, who were killed in a tragic accident in 2004 while driving a rented Chrysler PT Cruiser that had been recalled for a power steering hose defect but had not been repaired. The car caught fire because of the defect while traveling on Highway 101 in Monterey County, causing a loss of steering and a head-on collision with a semi-trailer truck.

In September 2012, Senators Boxer, Schumer and McCaskill

announced that all major car rental companies – Hertz, Enterprise, Avis Budget, Dollar Thrifty, and National – agreed to voluntarily stop the renting or selling of vehicles that have been recalled by their manufacturer and endorsed the legislation.

Although the bill has the support of the major rental car companies and consumer advocates, the Alliance of Automobile Manufacturers – which includes GM – has opposed the bill and is working to prevent it from moving forward in the Senate. The National Automobile Dealers Association, which includes many GM franchise dealerships, is also opposed to the legislation.

Boxer made clear that Barra’s stance is especially troubling in light of GM’s promise to cover the cost of interim rental vehicles while its customers wait for their vehicles to be repaired. Although the major rental car companies have pledged to keep unsafe vehicles off the road, there is no assurance that a driver will be placed in a safer vehicle since there is no federal law that prevents unsafe, recalled vehicles from being sold or rented to consumers.

Senator Boxer pointed out,

“So you can send your owner of one of these cars to a rental place to get a loaner … and they could get a defective car.”

The legislation is also endorsed by American Car Rental Association, Consumers for Auto Reliability and Safety, AAA, Advocates for Highway and Auto Safety, Consumers Union, and State Farm Insurance.

Good Morning America:

Are used car dealers selling cars with open safety recalls?

April 2, 2014

Credit: Good Morning America

Good Morning America undercover investigation finds car dealers selling unsafe, recalled used cars, claiming they are safe -- including the Chevy Cobalt with the ignition switch defect that led to GM's massive safety recall and hearings before the US House and Senate. Major franchised new car dealership in Los Angeles sold recalled 2004 PT Cruiser to young actor, age 18, as his first car -- without bothering to have the safety recall repairs performed.

Watch the story:

abcnews.go.com/blogs/business/2014/04/gma-investigates-are-used-car-dealers-selling-cars-with-open-recalls

Consumer Financial Protection Bureau and U.S. Department of Justice Tackle auto dealer markups on auto loans

CARS President joins civil rights, consumer rights leaders on auto lending panel at CFPB

Richard Cordray, Director of the Consumer Financial Protection Bureau

Federal regulators, including the Consumer Financial Protection Bureau, have put auto lenders on notice they face a new level of scrutiny over their discriminatory auto lending practices, which result in minority car buyers being charged extra amounts in hidden excessive interest rates, despite having the same credit as non-minority borrowers.

According to CFPB Director Richard Cordray, "Some people end up paying more on their auto loans than their neighbors – with the difference being not their creditworthiness but their race or ethnicity. Such discrimination may result in millions of dollars in unjustified consumer harm every year in the auto lending industry."

Lenders such as Ally Bank have notified stockholders that they face the possibility of fines or other penalties linked to legal action over discriminatory auto lending. Ally Bank, formerly named the General Motors Acceptance Corporation, collapsed during the recession and was bailed out by taxpayers, to the tune of tens of billions of dollars. In 2004, GMAC settled similar litigation brought on behalf of African American and Latino borrowers who were charged higher dealer "markups" than their white counterparts who had similar credit.

Washington, DC (11/14/13): CARS President testifies at Consumer Financial Protection Bureau Auto Finance Forum regarding auto dealer markups on auto loans

New York Times: Scrutiny over disparity in loan fees at auto dealerships

CARS President Rosemary Shahan testified on a panel with Stuart Rossman from the National Consumer Law Center, Hilary Shelton from the National Association for the Advancement of Colored People (NAACP), and a representative of the Minority Auto Dealers Association. Rosemary stated that CARS opposes dealers being able to charge extra hidden fees that add to the interest rates consumers pay for auto financing. For many years, CARS has spearheaded efforts in California to reduce the risk of discriminatory auto lending and the costs car buyers pay for dealer markups. In 2004, CARS sought to cap dealer markups at $150 per transaction, via the Car Buyer Bill of Rights, a ballot initiative that statewide polling showed to be extremely popular. As the result of a watered-down legislative compromise, CA ended up with caps on dealer markups -- 2.5% for loans up to 60 months and 2% for longer loans. Except for Louisiana, California is the only state with a law that caps dealer markups.

On October 30, CARS filed the Car Buyers Protection Act, a new ballot initiative to make newer, cleaner, safer vehicles more affordable, including flat-out prohibiting dealer markups on auto financing. Among likely voters in 2014, that provision polls at an overwhelming 82% support.

Spokespersons testify before Consumer Financial Protection Bureau Auto Finance Forum. Panelists (from left): Rohit Chopra (CFPB), Damon Lester (National Association of Minority Automobile Dealers), Rosemary Shahan (CARS), Hilary Shelton (NAACP), Stuart Rossman (National Consumer Law Center)

Read more:

CFPB Director Richard Corday's remarks at the CFPB's Auto Finance Forum

Civil rights and consumer advocacy groups clash with auto dealers and lenders --

watch video of

Consumer Financial Protection Forum on Auto Financing

Wall Street Journal: Banks press car dealers on loan practice

US Department of Justice files lawsuit alleging auto lending discrimination in Los Angeles

LA Times: "Car dealer, immigrants settle suit -- Chinese-speaking buyers were falsely told bad credit meant they must take high-interest loans, plaintiffs say. Financial award is undisclosed."

NY Times: GM nears settlement in lawsuit over lending

###

New York Times: Dealer fees for arranging car loans are drawing scrutiny from U.S.

November 14, 2013

By Rachel Abrams

"When Pedro Lantigua, a 32-year-old truck driver from Oklahoma City, decided to trade in his vehicle last summer, he walked into his local dealership and drove off with a brand-new Chevrolet Silverado. Like millions of Americans, he agreed to a loan arranged by the dealer.

Unlike most buyers, Mr. Lantigua actually knows how much he spent on that service, but only because the details came out when he sued the dealer for breach of contract related to his trade-in.

Mr. Lantigua agreed to pay $609 a month, meaning he would own the truck in about six years. But Mr. Lantigua said he did not know that his 12.6 percent interest rate included about $1,000 for the dealership, David Stanley Chevrolet, which arranged Mr. Lantigua’s loan through Ally Bank, according to Mr. Lantigua’s lawyer, Kathi Rawls.

Dealers often arrange loans for car buyers through third-party lenders, providing something of a one-stop shop for about 80 percent of all consumers who need financing. Dealers can decide how much they want to charge for that service and tack their fee onto the lender’s interest rate.

"Individual consumers usually don’t even know that they’ve been marked up," said Rosemary Shahan, the president of Consumers for Auto Reliability and Safety, a nonprofit consumer advocacy group.

Dealerships are not required to disclose what percentage of the interest rate goes to them, and consumer advocates and some regulators are concerned that dealers’ ability to decide how much to charge has led to discriminatory lending against minorities. That concern has prompted a number of government investigations into the growing business of auto lending"

Read more:

New York Times report

CARS files Car Buyers Protection Act Initiative

for the Nov. 2014 Ballot in California

Statewide polling shows overwhelming support among likely voters

88% favor safety recall provision

The Car Buyers Protection Act will:

- Make it illegal for car dealers to sell, rent, lease, or loan used vehicles that are under a federal safety recall, unless the safety recall repairs have been performed

- Improve protections for car buyers who are victims of ID theft at auto dealerships

- Prohibit dealers from hiring people convicted of ID theft, forgery, or other fraud, for positions where they would have access to car buyers' personal financial information

- Prohibit dealers from engaging in "bait and switch" financing (also known as yo-yo financing)

- Prohibit dealer markups – hidden extra charges that raise the cost of financing car purchases and cost California car buyers over $2.6 billion in a single year

- Require all dealers to provide at least a 30 day / 1,000 mile warranty (currently, only “buy here pay here” dealers are required to provide minimum warranties, so many other dealers continue to sell faulty vehicles “AS IS”)

- Eliminate the New Motor Vehicle Board's authority to overrule the DMV when the agency disciplines an auto dealer or manufacturer for violating consumer protection laws

Read more:

News Release

California Statewide Polling Results

Car Buyers Protection Act -- Summary and background about each provision

TEXT of Car Buyers Protection Act filed with CA Attorney General

"Car dealers would see new rules under California ballot initiative push"

Sacramento Bee

October 30, 2013

By Jeremy White

"Sen. Hannah-Beth Jackson , D-Santa Barbara, and advocates announced the filing of a proposed ballot measure that would impose new restrictions on automotive sales.

Car sale safety has already been a focus for Jackson, who last session authored a stalled bill that would bar dealers from selling or leasing cars that have been targeted by safety recalls unless they’ve repaired the cars. Jackson said she plans to revive the legislation during the upcoming legislative session, an effort that would now proceed against the backdrop of an initiative push.

'We should be able to rely on these vehicles as being safe, particularly when they’re purchased from a car dealer,' Jackson said during Wednesday’s call."

Read more:

Sacramento Bee report

Initiative would tighten regulations on used car sales

Capitol Public Radio

October 30, 2013

by Katie Orr

"Federal law dictates car dealers must fix any manufacturer safety recalls before selling new cars. A ballot initiative filed today would require dealers in California to do the same when selling or leasing used cars.

Democratic State Senator Hannah- Beth Jackson is supporting the measure."

Read more:

Capitol Public Radio Report

California new car dealers claim Tesla violates advertising laws

Los Angeles Times

September 16, 2013

By Jerry Hirsch

"The trade group for California’s new car dealers wants the state Department of Motor Vehicles to investigate Tesla Motors' advertising practices, alleging that the upstart automaker is violating various state and federal laws in marketing its electric cars.

One consumer advocate said the car dealers group filed the complaint to protect its own interest.

'They want you to have to go to the dealer where they will mark up your loan, do bait-and-switch financing and engage in all sorts of practices that I am far more concerned about,” said Rosemary Shahan, president of Consumers for Auto Reliability and Safety, in Sacramento.

Shahan noted that the car dealers group did not estimate how much Tesla’s advertising practices might cost California consumers and 'without seeing any numbers it is hard to say how concerned we should be about Tesla's advertising.'"

Read more:

Los Angeles Times report: new car dealers seek investigation of Tesla's advertising

Limo Safety Bill Passes Key Committee

San Mateo Daily Journal

August 31, 2013

"Limousines that carry 10 passengers or fewer will get annual inspections, two working fire extinguishers and assurances by owners to authorities that the vehicles meet applicable standards under a safety bill that sailed through a key legislative committee yesterday. The bill authored by state Sen. Jerry Hill, D-San Mateo, was sparked by the May 5 fatal limousine fire on the San Mateo-Hayward bridge that killed five women headed to a Foster City bridal celebration when they couldn’t escape the smoke and flames.... The bill is backed by the California State Sheriffs’ Association, California Professional Firefighters, California Fire Chiefs Association and Consumers for Auto Reliability and Safety."

Read more:

San Mateo Daily Journal report: Limousine Safety Bill Passes Key Committee

Critics: Car Dealer "Yo-Yo" Practices Affect "Most Vulnerable" Buyers

Credit: ABC News

ABC News -- Good Morning America

August 28, 2013

CARS contributed to this major investigative report

"It's named after a harmless children's toy, but the word yo-yo means something quite different in the car business. Consumer groups are warning Americans about the growth of so-called yo-yo financing – a practice in which car buyers leave a dealership with their new vehicle... Sometimes the consumer is told later there is a problem with their financing and that they must return the car. Critics say dealers then sometimes pressure the buyer to sign a new, and often more expensive deal."

Read more:

"ABC Good Morning America" exposes car dealer "bait and switch" financing scam

Personal Finance: High-Rate Loans Get Scrutiny

By Claudia Buck

Sacramento Bee

August 25, 2013

"In 2011, state Assemblyman Roger Dickinson, D-Sacramento, introduced a bill that proposed capping interest rates on car-title loans at 36 percent. It included other consumer protections, such as an extra 30 days for borrowers to repay before their vehicle is repossessed....'Most states don't allow auto- title loans. Why should California be behind on this issue?' said Rosemary Shahan, president of Consumers for Auto Reliability and Safety, who testified in favor of Dickinson's bill."

Read more:

"Sacramento Bee report: High-Rate Loans Get Scrutiny"

Flood cars from Hurricane Sandy Show up on Used Car Lots

Hurricane Sandy flood car. Credit: ABC News

ABC's "The Lookout"

July 31, 2013

CARS contributed to this major investigative report

"When superstorm Sandy pummeled the Northeast last October the damage was widespread. Nearly 300 people lost their lives, and thousands more lost their homes. Then there were the cars. According to the National Insurance Crime Bureau, an estimated 250,000 cars were submerged for days in corrosive saltwater....In a five month investigation, "ABC's The Lookout" found these cars turning up on used car lots across the country."

California agencies tackle rules of road for driverless cars

Daily Republic

June 21, 2013

"Industry representatives said they must test the technology in all kinds of conditions. Safety advocates see it differently. 'Should we just let you decide your car is ready to go over Donner Pass in a snow storm? Or should we require you to … prove to us that your car is ready?” asked Rosemary Shahan, president of Consumers for Auto Reliability and Safety. “I would argue that there should be some regulation.' "

Read more:

Daily Republic report on driverless cars

'Car Title Loans' a Road to Deep Debt

By Carolyn Said

San Francisco Chronicle -- front page

May 3, 2013

"While 31 states have outlawed car-title loans, a loophole in California law allows unlimited interest on some secured loans for more than $2,500. Now, consumer advocates, who call the loans predatory, are urging state legislators to take action, either to ban the loans outright or cap interest at 36 percent. The federal government implemented that same cap for auto-equity loans to military members.

'Car lenders say they have to charge so much because they're high-risk loans,' said Rosemary Shahan, president of nonprofit advocacy group Consumers for Auto Reliability and Safety. 'There's no risk. They just show up and take your car if you don't pay. They can resell it to recoup their costs.'"

Read more:

San Francisco Chronicle: "'Car Title Loans' a Road to Deep Debt"

BOXER PRAISES COMMITTEE PASSAGE OF LEGISLATION TO ENSURE SAFETY OF AMERICA’S RENTAL CAR CUSTOMERS

Legislation Would End the Practice of Renting or Selling Vehicles Under Safety Recall

Sen. Barbara Boxer (D-CA)

– U.S. Senator Barbara Boxer (D-CA) today praised the Senate Committee on Commerce, Science and Transportation’s passage of the Raechel and Jacqueline Houck Safe Rental Car Act of 2013, legislation that will ensure the safety of America’s rental car fleet by preventing rental car companies from renting or selling cars or trucks that are under safety recall. Senator Boxer is a lead sponsor of the bipartisan measure along with Senators Chuck Schumer (D-NY), Lisa Murkowski (R-AK) and Claire McCaskill (D-MO). The bill passed the committee by a unanimous voice vote.

The legislation is named in honor of Raechel and Jacqueline Houck, two sisters from Santa Cruz, ages 24 and 20, who were killed while driving a recalled Chrysler PT Cruiser they had rented from Enterprise in 2004. About a month before the deadly crash, Enterprise received a recall notice that the PT Cruiser had a defective power steering hose that was prone to catching fire and that it would be repaired by Chrysler free-of-charge. Despite the warning, Enterprise did not get the vehicle repaired and rented it out to three other customers before renting it to the Houck sisters. The defect caused the car to catch fire and crash head-on into a tractor-trailer, killing both sisters.

Cally Houck

Their mother, Cally Houck, has since joined with consumer groups in support of the legislation, which would close a loophole in safety standards by requiring rental car companies to ground recalled vehicles as soon as they receive a safety recall notice and prohibit them from being rented or sold until they are fixed. Auto-dealers are already subject to these requirements and the bill would simply extend the same requirements to rental car companies.

“Today the Commerce Committee paid tribute to two of my California constituents who lost their lives in a senseless tragedy by passing the Raechel and Jacqueline Houck Safe Rental Car Act,” Senator Boxer said. “This bill will protect our families by keeping vehicles under safety recall off our roads, and I will be working hard to ensure its passage by the full Senate.”

“If this bill had been in effect when my daughters rented that recalled car, they would still be alive today,” said Cally Houck.

“No other parents should have to suffer such a horrific loss because a rental car company hasn’t bothered to get an unsafe recalled car repaired.”

Senator Charles Schumer

added Rosemary Shahan, President of Consumers for Auto Reliability and Safety.

The legislation is supported by all of the major car rental companies – Hertz, Enterprise, Avis Budget and Dollar Thrifty – as well as Consumers for Auto Reliability and Safety, Advocates for Highway and Auto Safety, the Center for Auto Safety, Consumer Action, the Consumer Federation of America, Consumers Union, the National Association of Consumer Advocates and the Trauma Foundation.

###

Car Dealers tell CA Legislators "Don't stop us from selling unsafe, recalled used cars"

Fatal Accident Sparks Debate at State Capitol

ABC 30 KFSN-TV Fresno, CA

Mother of Crash Victims Testifies in Support of Senate Bill

Fox 5, San Diego

Calif. Lawmakers slam brakes on used-car safety bill

Bill spawned by CHP Officer's death stalls

Rosemary Shahan, president of CARS, tells Today Show

about hazards of unsafe, recalled cars

Today Show Investigation:

Car dealers caught on camera

selling unsafe, recalled used cars

March 7, 2013

The TODAY Show's Jeff Rossen, Josh Davis and their news team went undercover and found licensed auto dealers selling cars without bothering to get the safety recall repairs done first -- even though the repairs are FREE. First TODAY scoped out cars that are under a safety recall, for sale on car lots in the Midwest. Then they went on the lots and asked whether the cars were safe. So -- did the dealers told them the truth, without the cameras in sight? What do you think?

Watch what happens when dealers are asked if an unfixed, recalled car is safe --

Today Show: Rossen Reports: Hidden cameras reveal cars for sale with potentially deadly safety flaws

Unsafe recalled cars can kill you, or your family. Even if you don't buy one. If the steering goes and the driver of an unrepaired, recalled car loses control, you are at risk -- even if you just happen to be nearby. Or if the brakes fail and a recalled SUV crashes into a car that your child is riding in. Last year, over 32,000 people died in motor vehicle crashes. Vehicle crashes are the #1 killers of people under the age of 34. For most people, the riskiest thing they do on a regular basis is to drive a car, or ride in one. Our highways are already risky places. The last thing we need is for vehicles with known safety defects to be on the roads.

Today Show investigative reporter Jeff Rossen confronts

auto dealer caught selling recalled vehicle on his lot

So it's important to get recalled cars fixed -- pronto. Last year, over 16 million vehicles were recalled due to defects like -- catching on fire, brake failure, cruise control that goes haywire, axles that break apart, and other life-threatening defects. Most owners got their cars fixed -- but millions didn't, and traded them in at dealerships across the U.S. where they are ticking automotive time bombs.

Polling shows overwhelming public support for ensuring that vehicles are safe and recall repairs are performed -- before vehicles are rented or sold.

CARS is spearheading efforts to get unsafe, recalled used cars fixed -- BEFORE people are hurt. Were you sold an unsafe, recalled car? We want to hear from you. Here's how to get in touch --

http://carconsumers.org/feedback.php

Where's the best place to check for safety recalls? Check out the manufacturer's website, call their toll-free number, or call a local dealer that sells the same make and model. The National Highway Traffic Safety Administration has also started a program to alert car owners by email about new safety recalls -- before you get a letter from the manufacturer. Here's where to register to get email notices from NHTSA, the nation's leading auto safety agency:

www-odi.nhtsa.dot.gov/subscriptions/index.cfm

In this Jan. 11, 2011 photo, a potential car buyer looks over used cars at a dealership in Sacramento, Calif. Rich Pedroncelli / AP

FTC: Let car buyers eat LEMONS!

NBC News

January 15, 2013

FTC's proposed used car rule a lemon,

critics claim

" 'The FTC really blew it," said Rosemary Shahan, founder and president of Consumers for Auto Reliability and Safety (CARS). "This industry has a real problem and the proposed rule changes do not address that.' [CARS comment: In fact, they would make things even worse for consumers.]

Shahan and other consumer advocates want the FTC to require more information on the Buyer's Guide that must be on every used vehicle offered for sale.

Consumer groups and law enforcement officials in many states demand more. They want the Used Car Rule to require dealers to disclose significant vehicle history information if they have it....In comments submitted to the FTC on behalf of the attorneys general in 40 states, the National Association of Attorneys General (NAAG) called the current Buyer's Guide 'archaic' and of 'limited value' to used car buyers.

'We think this a lost opportunity,' said NAAG's Bill Brauch. 'When it comes to a used vehicle, nothing is more important for a consumer to know than its history. Was it previously wrecked, flooded, or a lemon law buyback?'"

Read more:

NBC News report

Cleveland Plain Dealer

Sheryl Harris, Consumer Reporter

December 11, 2012

"State attorneys general, including Ohio's, and groups like CARS had encouraged the FTC to expand the buyers guide to include information on whether the car was ever declared an insurance loss because of a flood or collision.That information is searchable through the National Motor Vehicle Title Information System, at vehiclehistory.gov. Rather than requiring dealers to check the system and include that information on the Buyers Guide, the FTC leaves that to consumers."

Read more:

Consumer Groups Say FTC's Used Car Rule a Lemon

South Coast Today

Beth Perdue

February 17, 2013

"A move by the Federal Trade Commission to modify its buyers' guide for used cars is being panned by consumer groups, who say the current guide is ineffective and proposed changes are even worse."

Read more:

Used Car Buyers Guide is no help in preventing fraud

ACT NOW!

Do you think that auto dealers should have to reveal -- in writing -- if they know that a car was totaled in a wreck, or was a flood car? Most people would say "of course." But not the Federal Trade Commission. If the FTC has its way, car dealers will NOT be required by the nation's premier consumer protection agency to tell you a single thing about the history or condition of the car -- even if the dealer KNOWS that it's worth thousands less than similar cars that weren't wrecked, or it's grossly unsafe.

CARS thinks that when you buy a car, you should not be the last to know what the dealer already knows about a car. After all, your life -- and the lives of your family, friends, and other passengers -- depends on your not getting stuck with an unsafe lemon.

Here's where to tell the FTC what you think -- please share this link with friends and post it on Twitter, Facebook, and other sites. All comments become part of the public record and can be accessed by others, including news media:

https://ftcpublic.commentworks.com/ftc/usedcarrulenprm

Superstorm Sandy will raise used-car prices nationwide

Victims of Hurricane Sandy.

Los Angeles Times

November 9, 2012

"The flood of Sandy-damaged cars further poses the risk that many will wind up in the hands of unscrupulous dealers peddling to unwitting consumers. The vehicles pose both financial and health risks.

'Cars that have been submerged in saltwater, and contaminated by bacteria and various toxins, will soon start to appear all over the country, even in states far from the center of the storm,' said Rosemary Shahan, president of Consumers for Auto Reliability and Safety.

Shahan said there were cases of Nissan vehicles flooded by Hurricane Katrina auctioned as 'new' as far away as California after that storm.

She urged shoppers to look for signs of flood damage, including engines that hesitate or run roughly, musty interior smells or signs of silt residue or premature rust.

Buyers should also run the vehicle information number through the National Motor Vehicle Title Information System at

vehiclehistory.gov. Insurers, salvage pools, auctions and junkyards in all 50 states are required to report all total-loss vehicles to this federal database within 30 days, Shahan said."

Read more:

"Los Angeles Times: Superstorm Sandy will raise used-car prices nationwide"

Buyer Beware: Cars flooded by Hurricane

Could turn up on the market

A flood vehicle from the storm.

New York Times

November 2, 2012

"Many cars submerged by the floods caused by Hurricane Sandy could eventually turn up on the automotive market. Consumer advocates warn that buyers need to beware of vehicles that have suffered water damage, only to be dried out and marketed by sellers who conceal their histories. Nevertheless, new federal regulations could help protect car buyers.

On Wednesday, Geico had already received 20,000 auto claims for flood and other damage from the East Coast, according to a statement issued by Tony Nicely, chairman of the company. State Farm said it had received 4,000 claims. Those numbers are expected to grow, and many of the cars are sitting in salty water, a particular threat to electrical systems and air bags.

In the past, consumer advocates and legislators worried that differences in state laws could allow a car described on its title, or "branded," as a flood vehicle in one state to emerge with a clean title in another state. Now, title-washing, as it is called, 'is much less of a problem,' said Rosemary Shahan, president of Consumers for Auto Reliability and Safety. Her group and other consumer advocates successfully sued the Justice Department in 2008, demanding that regulations be issued.

The result, Ms. Shahan said, is that

vehiclehistory.gov tells consumers whether a vehicle has been totaled regardless of lax state titling laws or interstate sales....Ms. Shahan noted, however, that some states do not brand vehicles as flooded." (Note: it is still important to ALWAYS have any car you're considering inspected before you agree to buy, even if it doesn't show up in the vehicle history database.)"

Read more: "

New York Times: cars flooded by Hurricane could turn up on market"

Tap Car Insurance After Hurricane Sandy

Tap into your insurance policy.

Fox Business News:

November 15, 2012

"...consumer advocates, including Rosemary Shahan, President of Consumers for Auto Reliability and Safety in Sacramento, Calif., say that once water gets in the car it becomes dangerous to your safety and health.

"Today the engines, brakes and air bags are all controlled by computers. It's very unreliable, especially of there's saltwater," Shahan says. She says that not only will the car corrode, but the car's interior will be saturated by contaminated water, making it hard to clean up."

Read more: "

Fox Business News: Tap Car Insurance After Hurricane Sandy"

Brian Ross reporting for Good Morning America.

ABC News

Good Morning America

Brian Ross, reporting from New York

September 28, 2012

St. Louis Post-Dispatch

September 27, 2012

USA Today

September 27, 2012

Boxer, Feinstein Introduce Legislation to Ensure Safety of America's Rental Car Fleet

U.S. Senators Barbara Boxer (L) and Dianne Feinstein take the lead in championing rental car safety. (AP file photo)

Legislation Would End the Practice of Renting or Selling Vehicles Under Safety Recall

August 2, 2012

Washington, D.C. – U.S. Senators Barbara Boxer and Dianne Feinstein (both D-CA) today introduced the Raechel and Jacqueline Houck Safe Rental Car Act of 2012, legislation that will ensure the safety of America's rental car fleet by preventing rental car companies from renting or selling cars or trucks that are under safety recall.

The two California Senators introduced the legislation named in honor of Raechel and Jacqueline Houck, two sisters from Santa Cruz, ages 24 and 20, who were killed while driving a recalled Chrysler PT Cruiser they had rented from Enterprise in 2004. About a month before the deadly crash, Enterprise received a recall notice that the PT Cruiser had a defective power steering hose that was prone to catching fire and that it would be repaired by Chrysler free-of-charge. Despite the warning, Enterprise did not get the vehicle repaired and rented it out to three other customers before renting it to the Houck sisters. The defect caused the car to catch fire and crash head-on into a tractor-trailer, killing both sisters.

Their mother, Cally Houck, has joined with consumer groups in support of the new legislation, which would close a loophole in safety standards by requiring rental car companies to ground recalled vehicles as soon as they receive a safety recall notice and prohibit them from being rented or sold until they are fixed. Auto-dealers are already subject to these requirements and the bill would simply extend the same requirements to rental car companies.

"We cannot allow another family to go through the pain and loss that Cally and her family have gone through," Senator Boxer said. "We will not rest until Congress has passed legislation that protects American consumers from these unsafe vehicles, and we urge all the rental car companies to join Hertz in committing to the safety of their customers."

U.S. Senators Barbara Boxer (L) and Dianne Feinstein (photo from earlier event)

Earlier this year, Senator Boxer sent a letter asking the nation's four leading rental car companies – Enterprise, Hertz, Avis/Budget and Dollar/Thrifty – to protect consumers from unsafe vehicles by making the following pledge: "Effective immediately, our company is making a permanent commitment to not rent out or sell any vehicles under safety recall until the defect has been remedied."

Of the four companies – which together control 92 percent of the rental car market – only Hertz agreed to the pledge in its entirety. Senator Boxer is continuing to urge the companies to take the pledge and fully protect their customers.

The Senate bill is the companion legislation to a bill introduced last month by Congresswoman Lois Capps (D-CA), Congressman Eliot Engel (D-NY) and Congresswoman Jan Schakowsky (D-IL). The new House and Senate bills are an updated version of legislation introduced last year by Senator Chuck Schumer (D-NY), Senator Boxer, Senator Feinstein and Senator Richard Blumenthal (D-CT).

The new House and Senate legislation is supported by Hertz, Consumers for Auto Reliability and Safety, Advocates for Highway and Auto Safety, the Center for Auto Safety, Consumer Action, the Consumer Federation of America, Consumers Union, the National Association of Consumer Advocates and the Trauma Foundation.

Would you "Like" Enterprise and other companies to

stop renting unsafe vehicles?

Show your support by "Liking" this on Facebook, by clicking the "Like" button below. Thanks!

Dispute Over Renting Recalled Vehicles Reaches a Crescendo

Rental car companies at the airport.

Roll Call

By Janie Lorber and Kate Ackley

July 17, 2012

"Consumer safety advocates may be on the verge of winning a years-long fight to ban rental car companies from renting and selling recalled vehicles.

Enterprise Rent-A-Car publicly opposed such proposals, but with a new bipartisan bill in the House and a companion measure expected to drop any day in the Senate, other industry players are joining the fray....Enterprise, one of the largest privately held businesses in the nation, has spent more than $200,000 on lobbying so far this year. In 2011 the company spent nearly $1 million, almost four times the amount spent by its major competitors - Avis-Budget and Hertz Rent-a-Car - combined.

'Without legislation, what Enterprise is doing is not enforceable. They can say they are doing it, but not really be doing it," said Pamela Gilbert, a lobbyist with Cuneo Gilbert & LaDuca, representing CARS. "They can do it today and stop tomorrow. In both cases, without a law, there isn't anything anyone can do about it.' "

Would you "Like" Enterprise and other companies to

stop renting unsafe vehicles?

Show your support by "Liking" this on Facebook, by clicking the "Like" button below. Thanks!

More Consumers with Bad Credit Scoring Car Loans

Arm yourself with information to improve your chances for approval.

By Allie Johnson

CreditCards.com

July 23, 2012

Get a good deal, at any score:

1. Know your score before you shop. Experts say it's not enough just to look at your credit report, which you can get for free from each of the major credit bureaus once a year at Annual Credit Report.com. You also should get your credit score, which can be purchased from the credit bureaus or on myFICO.com. (According to myFICO.com, you have three separate FICO scores, one for each of the major credit bureaus.) "Make sure you know your credit score and it's very recent so they can't say, 'Oh it used to be good, but now you have a ding and this is the best we can do,'" says Rosemary Shahan, president of Consumers for Auto Reliability and Safety (CARS).

Read more: at

Fox Business

Hertz, Enterprise at odds over changes to car-rental risks

Will all the rental companies ever agree to put consumers first?

Philadelphia Enquirer

June 25, 2012

by Jeff Gelles

"In hindsight, many of the vehicle crashes that kill more than 30,000 people a year in the United States seem utterly senseless — avoidable if a drunk had just stayed off the road, a distracted driver had let a text go unanswered, or a commercial driver had been better rested or less worried about the costs of delay.

Even in that sad litany, the deaths of Jacqueline and Raechel Houck stand out: preventable by a simple fix in car-rental practices. Yet, after two years of crusading to get rental-car companies to change their ways, their bereaved mother, Carol "Cally" Houck, still hasn't quite succeeded."

Read more: at

Philly.com

Would you "Like" Enterprise and other companies to

stop renting unsafe vehicles?

Show your support by "Liking" this on Facebook, by clicking the "Like" button below. Thanks!

Cally Houck pushes rental car companies to stop leasing out unsafe, recalled cars

Cally Houck sits by pictures of her daughters.

Huffington Post

June 20, 2012

By Sharon Silke Carty

"Cally Houck wants rental car companies to promise they won't rent or sell a vehicle until any safety recall issue is addressed. So far, only one rental car company -- Hertz Rental -- has promised to permanently stop the practice. Other companies have said they are on board, but won't promise to never rent a recalled vehicle and not fixed.

"It's so simple, so simple," Houck said. The rental companies "just don't want to be told what to do." Houck has found a ally in the Senate in Boxer, who is planning to introduce a bill similar to one proposed last year by Sen. Chuck Schumer.

On May 7, Boxer gave the major car rental companies 30 days to sign a pledge saying they would stop renting recalled vehicles. She announced last week that only Hertz made that commitment"

Read more: at

The Huffington Post

Would you "Like" Enterprise and other companies to

stop renting unsafe vehicles?

Show your support by "Liking" this on Facebook, by clicking the "Like" button below. Thanks!

"Buy Here Pay Here" auto sales bill gaining ground

Buy Here, Pay Here lot in L.A.

Los Angeles Times

June 25, 2012

by Marc Lifsher

"Legislation to regulate the sale of high-mileage cars to credit-risky motorists breezed through a key committee of the state Assembly, despite growing opposition from so-called Buy Here Pay Here auto dealers. The bill by Sen. Ted Lieu (D-Torrance) would cap interest rates on loans provided by the sellers at just over 17%. Currently, unregulated interest rates can run as high as 30%, Lieu said.....

But consumer groups complained that dealers in this fast-growing automobile market segment reap large profits by repossessing the same car as many as eight times. 'Part of the industry's basic design is for these loans to fail,' said Rosemary Shahan, executive director of Sacramento-based Consumers for Automobile Reliability and Safety, which supports the Lieu legislation."

Read more: at

The L.A. Times

Would you "Like" Enterprise and other companies to

stop renting unsafe vehicles?

Show your support by "Liking" this on Facebook, by clicking the "Like" button below. Thanks!

4 rules for getting a car loan

Time / Moneyland

June 18, 2012

by Martha White

"If your credit is good, you still should not assume that you’ll qualify for the 0% financing offers many dealers dangle in their TV and radio ads, says Rosemary Shahan, president of Consumers for Auto Reliability and Safety. She says roughly nine out of 10 buyers never qualify for that and wind up paying a higher rate.

Shop Around

“Our number-one piece of advice for consumers is never, ever get your loan from the dealer,” Shahan says. It’s advice other consumer advocates echo.

“Get preapproved for financing before you set foot in the dealership,” says Chris Kukla, senior counsel for government affairs at the Center for Responsible Lending."

Read more:

http://moneyland.time.com/2012/06/18/4-rules-for-getting-a-car-loan/#ixzz1yPWYunTd

CA legislation to curb "Buy Here Pay Here" auto sales scams faces stiff opposition from

auto dealers who sell overpriced, junky cars to vulnerable consumers

"The legislation was introduced early this year to regulate the large Buy Here Pay Here industry that operated mostly out of the spotlight. Unlike other used car dealers, Buy Here Pay Here lots offer their own in-house financing, allowing them to sell to consumers with damaged or nonexistent credit. Critics say that the dealers charge interest rates that can top 30%, mark up the cost of cars far beyond their value and sell vehicles in poor condition."

Read more:

Los Angeles Times report, June 9, 2012

Three bills targeting buy here pay here dealers continues to advance.

Los Angeles Times

June 1, 2012

"In particular, the [buy here pay here dealers] opposed a provision that would require Buy Here Pay Here dealers to offer a warranty covering major components for at least 30 days or 1,000 miles. Currently most cars on such lots are sold on an as-is basis."

Read more:

Los Angeles Times June 1, 2012

Shady car dealers targeting military buyers

Car dealer rip-offs affect mission readiness

MSNBC report by Herb Weisbaum

May 31, 2012

Rosemary Shahan, president of Consumers for Auto Reliability and Safety, has a long list of “unconscionable practices” she says unethical dealers use on military buyers. They include: falsifying loan applications, bait-and-switch financing and selling a car they know has been in a wreck without telling the customer.

“Auto sales and financing scams are leading causes of financial readiness problems for military service members and their families,” she says.

Read more:

lifeinc.today.msnbc.msn.com/_news/2012/05/31/11959202-shady-car-dealers-targeting-military-buyers

Money Magazine: Heroes

A yearlong celebration of 40 people who have made extraordinary efforts to improve others' financial well-being.

May 2012

"A Driving Force for Lemon Laws"

Rosemary Shahan, President and Founder of Consumers for Auto Reliability and Safety

Why she's a hero: Shahan, 62, has spent three decades fighting on drivers' behalf for more effective repairs, improved safety, and fairer financing.

Read article:

money.cnn.com/galleries/2012/pf/1205/gallery.consumers-customer-service.moneymag

Auto safety activist Rosemary Shahan turns lemons into legislation

Los Angeles Times

April 1, 2012; by Ken Bensinger

"Shahan is the founder and president of Consumers for Auto Reliability and Safety (CARS). The Sacramento organization has been the driver of some of the most important advances in auto-related safety and financial protection regulation on the books today.

Shahan, 62, championed the nation's first lemon law in California, which has since been copied in every state. She was a major force behind the federal air bag mandate and laws protecting military service members from abusive car loans. And she's not finished."

Read article:

articles.latimes.com/2012/apr/01/business/la-fi-himi-shahan-20120401

Three bills to rein in buy here pay here dealers advance.

Los Angeles Times

April 25, 2012

by Marc Lifsher

"These dealers advertise that they have transportation for people who need to go to work and give people a way to improve their credit," said Rosemary Shahan, executive director of Consumers for Auto Reliability and Safety. "Instead, the exact opposite happens, and they are left with a car that breaks down right away and needs repairs that they can't afford."

Read article:

www.latimes.com/business/la-fi-buy-here-pay-here-20120425,0,6508765.story

Buy Here Pay Here auto dealers scam consumers

Sky-high interest rates, cars that break down soon after purchase, inflated prices, and little protection for car buyers.

Los Angeles Times report exposes the shady dealings of "Buy-Here-Pay-Here" dealerships.

Over a period of months, CARS contributed to this major three part series, which has garnered attention around the nation.

Part One: A Viscious Cycle in the Used Car Business

How auto dealers profit from "churning" used cars that break down soon after purchase and need expensive repairs the buyers can't afford

The Los Angeles Times

by Ken Bensinger

October 30, 2011

Read more:

www.latimes.com: Buy Here Pay Here part 1

Part Two: Wall Street investors place big bets on Buy-Here-Pay-Here auto dealers

Exploiting the poor pays big dividends for fat cat lenders

The Los Angeles Times

by Ken Bensinger

November 1, 2011

Read more:

www.latimes.com: Buy Here Pay Here part 2

Part Three: A hard road for the poor in need of cars

Non-profit programs help struggling families get better jobs, improve their education, and transform their lives

The Los Angeles Times

by Ken Bensinger

November 3, 2011

Read more:

www.latimes.com: Buy Here Pay Here part 3

California Passes First-in-Nation Protections for Car Buyers

Van Nuys News Press

Sept. 6, 2011

"This bill unleashes the power of technology to provide first in the nation consumer protections, cut red tape, and help save the state millions," said [California Assemblymember Robert] Blumenfield. "Buying a car, especially a used one, requires some detective work to determine its safety and value. By requiring junk cars and death traps to be flagged with a

warning sticker, consumers can see these vehicles for what they really are when shopping for a car."

The bill implements a first in the nation requirement that car dealers post a red [warning} sticker on the used cars they sell that are flagged in a federally mandated database – the National Motor Vehicle Title Information System – as "junk," "salvage," or "flood" branded vehicles.

Read more:

http://www.vannuysnewspress.com/news/2011/09/06/legislature-passes-first-in-nation-protections-for-car-buyers/

CARS spearheaded the successful effort to include the warning sticker provisions in the bill. Law enforcement agencies and officials joined in supporting the measure, after the pro-consumer changes were made. California Governor Jerry Brown has signed the bill into law. It is scheduled to kick in, beginning on July 1, 2012. Meanwhile, consumers can check the NMVTIS database directly, by

clicking on:

http://www.vehiclehistory.gov.

Wreck Repairs

Can you trust your insurer to tell you where to go for repairs, after a wreck? Not necessarily.

KGO-TV 7 on Your Side, with Michael Finney

September 2, 2011

"Steering is like HMOs for car repair, where the insurance company wants you to go to a place where they control the repairs and they don't necessarily have your interest at heart," said Rosemary Shahan, an automobile consumer advocate with C.A.R.S. Shahan says there can be a close relationship between the insurer and auto body shops that work against the consumer, but the law is clear: You are in charge.

Watch report:

http://abclocal.go.com/kgo/story?section=news/7_on_your_side&id=8340728