Tennessee Law Fuels Used-Car Recall Fight

Automotive News

December 27, 2017

by Eric Kulisch

"Proponents of a new Tennessee law regulating sales of recalled vehicles call it a step forward in closing what some call the used-car loophole. Consumer and safety groups call it a sham that's written not to protect consumers from dangerous cars, but to shield dealers from lawsuits.

At issue is whether disclosure of an open recall offers the consumer enough protection against a safety defect.

Under federal law, new vehicles with open recalls cannot be sold. But the ban doesn't extend to used vehicles. That gap has frustrated efforts by manufacturers and safety regulators to improve recall repair rates, as vehicles under recall get harder to track as they pass from owner to owner. Efforts in Congress to close the loophole sputtered amid opposition from dealer groups, as did an effort by AutoNation to withhold recalled used cars from the retail market.

The Tennessee measure, which takes effect Jan. 1 and was supported by the state's dealer lobby, doesn't bar the sale of used vehicles with pending recalls. Rather, it requires dealers to check a recall database before selling a vehicle and either perform the recall repair or notify the customer of any defect. Customers would have to sign a form acknowledging they were notified. (Vehicles subject to a manufacturer's do-not-drive order would have to be repaired before sale.) ....

Yet safety advocates say the policy is a cop-out. They warn that the disclose-and-sell rule sets a precedent for other states to roll back safeguards for used-vehicle purchases, which are governed in many states by consumer protection laws. Rather than increase transparency, they say, the law attempts to shield dealerships from responsibility if a vehicle sold with a recall is involved in an accident.

'They are trying to legalize fraud,' Rosemary Shahan, president of Consumers for Auto Reliability and Safety, told Automotive News. 'It's written to protect unscrupulous car dealers.'

While there's no federal law barring sales of used vehicles under recall, used-car buyers are indirectly protected by state and federal laws against unfair and deceptive trade practices. The Tennessee law is designed to nullify those types of protections, Steven Taterka, a former assistant state attorney general who represents consumers in auto fraud cases, said during a conference call for reporters."

Read full report:

Automotive News, Tennessee Law Fuels Used-Car Recall Fight

Read more, including

how to avoid being victimized by dealers who sell unsafe, defective recalled cars

"Will Equifax Ever Be Held Accountable for Its 'Rookie Mistakes'?"

Forbes

November 15, 2017

By Diana Hembree

"For a few bracing weeks this fall, consumers harmed by Equifax, Wells Fargo or another financial institution had the right to their day in court.

Trump caves in to Wall Street crooks, betrays consumers and our military heroes and veterans (click image for larger version)

But in late October, Senate Republicans voted to overturn the newly minted rule by the Consumer Financial Protection Bureau, which gave consumers the right to join class-action lawsuits against banks, credit bureaus and lenders. Now consumers' only recourse is a secret arbitration hearing – which corporations

win 93 percent of the time.

'This vote marked a truly shameful moment in Congress,' said Amanda Werner, campaign manager for Americans for Financial Reform and Public Citizen, who

dressed as Monopoly Man to 'troll' Equifax CEO Richard Smith during a Senate hearing in October. 'Just weeks after holding hearings on scandals of historic proportion, the Senate granted Equifax and Wells Fargo a "Get Out of Jail Free" card.'....

'In its business model, customer privacy and data is Equifax's biggest concern and most prized asset,' [cybersecurity expert] Moehlenbruck observes. 'But it seems that adequate security training and other best practices weren't in place to guard it.'

Consumer advocates say that the best way to drive home that and other pro-consumer messages is to take negligent corporations to court. Of course, the Senate and Trump just took away consumers' right to sue financial institutions, noted Rosemary Shahan of Consumers for Auto Responsibility and Safety (CARS), adding that many car owners ruined financially in an auto loan scandal at Wells Fargo now have little hope for justice. 'It hurts, but we'll keep on fighting,' she says. 'I expect more people will send a message on election time, especially since abuses will likely proliferate – especially because corporations no longer feel they have to be on their best behavior.'"

"Car Loan from Wells Fargo? You May Be Entitled to Compensation"

MoneyGeek.com

September 30, 2017

By Steve Evans

"If you took out a car loan from Wells Fargo, pay close attention to the news, your mail, and your bank accounts. After a new round of controversy, the company has promised to reimburse car loan consumers who were wrongly charged for car insurance that they didn't ask for or need.

The situation is summed up in a class action complaint that alleges the bank signed up more than half a million car loan customers for unnecessary auto insurance. Among other charges, plaintiffs in the case also allege Wells Fargo violated the RICO Act, or racketeer-influenced corrupt organization act, a federal law that dates to 1970 and was enacted to battle organized crime.

The lawsuit comes less than a year after the bank stirred up public outrage for opening millions of unauthorized accounts for customers who never asked for them and often charged fees to maintain the accounts....

Consumer advocates say that this latest episode is part of a trend. "There's a litany of wrongdoing on the part of Wells Fargo," says Sally Greenberg, executive director of the National Consumers League in Washington. "We've moved our organization's money out of the bank. They're a poster child for bad corporate behavior and at this point nothing surprises me."

Unfortunately, for consumers who lost their cars and their good credit ratings because of extra charges, the damage is already done. In some cases, such a hit can ruin careers, says Rosemary Shahan, president of CARS and a longtime activist who is working with service members and their families affected by the Wells Fargo fallout. 'It's a really serious problem because if you have financial issues, you can become a security clearance risk in the military,' she says. 'Some of these people have had their credit ratings badly damaged, and they risk having their security clearance revoked.'

The Servicemembers Civil Relief Act protects service members who are on active duty out of the country by blocking lenders from summarily foreclosing on their homes or repossessing a vehicle. 'You have to get a court order before you can do that,' Shahan says. 'But Wells Fargo admitted that they did not even bother to check the database for anyone in the military. Every bank knows the CRA is there; there is no excuse for not checking military status. It's not hard to do; it's their job. And when somebody is in a war zone, serving our country, it's not too much to ask.' "

Read more: MoneyGeek.com:

Car Loan from Wells Fargo? You May Be Entitled to Compensation

" 'Flood Cars' Sneaking onto the Market after Hurricanes"

MoneyGeek.com

September 19, 2017

by Diana Hembree and Steve Evans

"Andrew Shawcroft was pleased with the new car he bought from an Oregon dealership in 2015: a 2004 Nissan Murano that he paid for with $12,000 in cash. What the 27-year-old high school teacher didn't realize was that it had all the signs of a "flood car" – a vehicle transported from the East Coast soon after Hurricane Sandy whose electrical system was so badly damaged a mechanic would later find it was in danger of exploding...

'Flood cars are a huge problem,' says Rosemary Shahan of Consumers for Auto Responsibility and Safety (CARS). 'There's no way to make them safe. They're basically rotting from the inside out and are loaded with bacteria and other contaminants that can cause serious health issues. But they will soon be popping up all over the country, including dealerships that will sell some of them as "new" cars.'

Last week, the Department of Justice issued an advisory warning about auto fraud after hurricanes Harvey and Irma. In a September 14 memo, the agency said that it is anticipating 'a high volume of flood-damaged automobiles' to be sold by unscrupulous dealers."

Read more: MoneyGeek.com:

"Flood Cars Sneaking onto the Market after Hurricanes"

"Wells Fargo may have lied to Congress about Fraudulent

Auto Loans, Consumer Coalition Says"

Benzinga / Money Geek

By Steve Evans

September 7, 2017

"Consumer outrage over Wells Fargo's business practices appears to be reaching critical mass.

On August 31, just hours after Wells Fargo revealed that employees had created at least another 1.4 million unauthorized consumer accounts, a coalition of 33 consumer groups fired off a letter to two congressional banking committees charging the bank may have lied to Congress last year about its fraudulent auto insurance sales.

Wells Fargo protects their profit and interests, but not yours.

The coalition, led by Public Citizen & Americans for Financial Reform, suggest top-ranking executives at Wells Fargo may have misled lawmakers during an active investigation last year. During congressional hearings held in September 2016, the executives "may have knowingly and deliberately withheld information" about the bank's fraudulent auto insurance sales practice, according to the coalition.

The auto loan scandal, broken by the New York Times earlier this month, revealed an internal Wells Fargo report that showed the bank had charged more than 800,000 people for auto insurance they did not need, leading 274,000 customers to become delinquent on their car loans and nearly 25,000 to have their vehicles repossessed. Some of them had their credit damaged, including enlisted military personnel who stand to lose security clearances as a result of damaged credit scores.

The consumer coalition reports that the bank's own timeline showed it was aware of the 800,000 customers sold unnecessary insurance in July 2016, several months before when the executives testified before the two banking committees in Congress. "Yet Stumpf's testimony made no mention of this misconduct, even when he was asked directly whether fraudulent activity might exist in other business lines," the coalition pointed out....

'GOP Senator Crapo and Rep. Hensarling have to decide whether to further expose Wells Fargo's illegal practices and deception of Congress, or cover them up,' said Rosemary Shahan of Consumers for Auto Reliability and Safety, one of the signatories to the consumer coalition letter. 'If they fail to hold Wells Fargo accountable, that will send a signal to all banking institutions that it's open season on American consumers.' "

Read more:

Benzinga / Money Geek: Wells Fargo may have lied to Congress... Consumer Coalition Says

How did Wells Fargo turn fees for items like $3 cups of coffee

into over $1 billion in profits? Well, it's like this:

"Lawsuit over Wells Fargo's Predatory Lending

Heads to Appeals Court on Friday"

Benzinga / MoneyGeek.com

By Steve Evans

August 23, 2017

"Scandals continue to buffet

Wells Fargo & Co. with each new accusation of misconduct, whether it's predatory lending, what board members knew about fake customer savings accounts or the bank forcing unwanted auto insurance on its customers who took out car loans.

But lesser-known legal problems have been stalking Wells Fargo since 2008, when it was among the major U.S. banks to be slapped with a nationwide class-action lawsuit for allegedly deceptive overdraft policies. For years, Wells Fargo and other banks reordered customer transactions from highest-to-lowest payments to maximize the overdraft fees they could collect...

A related class-action lawsuit in California involving overdraft fees was settled in 2016, with Wells Fargo ordered to repay $203 million to customers. A federal judge reaffirmed his ruling that Wells Fargo had misled customers to think the transactions were paid chronologically when they were actually paid in a high to low order solely to yield more overdraft fees.

The average award payout for the more than one million members of the California class action suit was $162, with a few members on the high end receiving several thousand dollars, according to Michael Sobol, one of the attorneys representing the plaintiffs...

A $39 cup of coffee

Here's how the contested overdraft policy worked: A customer who had, say, $74 in the bank might use a debit card for a $3 coffee, a $7 lunch and then pay a $75 Internet bill. By reordering the transactions, Wells Fargo would deduct the $75 first, which would throw the account into overdraft, then debit the $7 lunch, followed by the $3 coffee, then charge overdraft fees on all three. The fees could reach as high as $37 each – meaning that cup of coffee ultimately cost $39. Just by juggling the transaction order, Wells Fargo would make an extra $74 or so in overdraft charges.

Add a few more small debits here and there, and bank customers could easily owe more than $200 in overdraft fees overnight – charges that would grow daily if they didn't realize the problem or couldn't pay them off immediately...

'There's no question that the high-to-low overdraft fees were set up solely to make more money for the bank, but they were a terrible deal for the consumer,' says Rosemary Shahan, president of Consumers for Auto Reliability and Safety (CARS) and a longtime activist for consumer rights....All the laws we've fought to get on the books to protect people don't mean a thing if banks can force you into arbitration,' Shahan says. 'If this (Wells Fargo case) goes to arbitration, most consumers would get hardly anything.'"

Read more:

Benzinga / MoneyGeek.com: Lawsuit over Wells Fargo's Predatory Lending Heads to Appeals Court on Friday

"At Center for Auto Safety, a New Leader for a New Era"

Fair Warning

By Chris Jensen

August 15, 2017

"Since 1970 the tiny Center for Auto Safety has wielded enormous influence through its campaigns to recall vehicles for safety-related defects and to push states to enact consumer protections such as lemon laws. But consumer advocates say the Washington, D.C.,-based nonprofit is entering a new and perhaps more challenging environment under the Trump administration. And, for the first time in four decades, it will be doing so under a new leader, Jason K. Levine,

who was named the center's executive director today.

Levine, 45, a consumer protection lawyer, will be the center's first new leader since 1976, replacing Clarence M. Ditlow, a legendary safety advocate who died last year of cancer at the age of 72.

The job 'will be more challenging than it has ever been before because the administration announced publicly they want to deregulate everything,' said Rosemary Shahan, the president of Consumers for Auto Reliability and Safety, a California-based group."

Read more:

Fair Warning: "At Center for Auto Safety, a New Leader for a New Era"

"Takata stocks tank during massive recall"

Detroit News

By Keith Liang

June 20, 2017

"

Washington - Stocks for Japanese air bag manufacturer Takata Corp.are taking a beating amid reports of a looming bankruptcy filing that could potentially upend the largest recall in U.S. history....

A Takata facility

A bankruptcy filing for the company is imminent, according to observers who have watched the air bag maker closely since federal regulators put it in the cross-hairs for making faulty air bag inflators that are prone to rupture in humid climates. The National Highway Traffic Safety Administration has recalled nearly 70 million of Takata's air bag inflators, placing the company in dire financial straits as it scrambles to repair the faulty parts....

Flying shrapnel from exploding Takata air bag inflators have led to a recall of nearly 70 million inflators. The faulty air bag inflators have been linked to 11 deaths and more than 180 injuries in the United States....

Lawmakers in Congress say Takata should be held responsible for fixing its faulty air bags, no matter what happens with its likely bankruptcy filing.

'The bankruptcy process must ensure that the defective Takata air bags continue to be replaced and injured drivers are effectively compensated,' U.S. Sen. Bill Nelson, the top Democrat on the Senate Commerce, Science and Transportation Committee, said in a statement. 'Anything less would amount to letting the company off the hook.'

Rosemary Shahan, president of the Sacramento, Calif.-based Consumers for Auto Reliability and Safety group, added: 'I'm concerned that if Takata goes bankrupt, that could slow down production of replacement air bags and increase risks among consumers who are often stuck driving unsafe recalled cars, while they wait for months for repairs.

'Some manufacturers, like Honda, have been providing loaner vehicles, but others, such as Ford, generally refuse requests for loaner cars — leaving their customers at risk of death or devastating injuries,' she said."

Read more:

Detroit News: Takata stocks tank during massive recall

Showdown between California car dealers and consumers

over e-contracting

Benzinga

by Steve Evans - MoneyGeek.com

May 31, 2017

"A bill to permit e-contracts in auto financing in California has alarmed consumer advocates and attorneys representing victims of unethical auto sales.

'E-contracts allow fraud on a scale I've never seen,' says San Diego attorney Hal Rosner, who represents hundreds of car buyers who have run into legal trouble with e-contracts. 'There is massive fraud going on here.'

Promoted by auto dealers as a convenience, e-contracts make it easier to cheat buyers, according to attorneys. Rosner says unscrupulous dealers have changed e-contracts to slip in fees and add-ons for extras his clients never agreed to, as well as higher purchase prices and down payments than they were promised. Some dealers even manipulate the promised trade-in value on old cars, he said...

Rosemary Shahan is fighting to stop it.

'Agreeing to an e-contract is not like swiping a credit card at the grocery store,' says Shahan, president and founder of Consumers for Auto Reliability and Safety (CARS), a Sacramento, Calif.-based non-profit. 'There's a lot more money on the line, and you don't have the same protections. They (car dealers) argue it will expedite the transaction, though that's not necessarily a good thing for consumers. You want time to review a contract and whatever it is you're agreeing to.'"

CARS note: The author of this anti-consumer bill is Matt Dababneh (D-Van Nuys). A super-rich major car dealer in his district who is very active politically owns Keyes Lexus, which is being sued for allegedly cheating low-income Spanish-speaking consumers by overcharging them for unwanted, expensive add-ons. One consumer alleges he was charge over $6,000 in unwanted add-ons, and that the dealership failed to provide a Spanish-language copy of the e-contract, even though that is required by California law. The consumer is seeking a permanent injunction to prohibit the dealer from engaging in similar practices in the future.

Letter from the consumer attorney who is representing the Spanish-language consumers

Read more:

Benzinga: Showdown between California car dealers and consumers over e-contracting

Letters from consumer groups opposing the bill:

Large coalition of pro-consumer, pro-economic justice organizations opposes AB 380

Consumers for Auto Reliability and Safety opposes AB 380 (Dababneh)

Consumer Federation of California

CALPIRG

Consumer Advocates Urge Investigation of Mystery BMW Fires

ABC News

May 17, 2017

by Cindy Galli, Stephanie Zimmerman, and Cho Park

ABC News exposes BMW mystery fires

"Officials from two leading auto safety organizations are calling for the National Highway Traffic Safety Administration (NHTSA), the federal agency tasked with investigating potential defects, to investigate a series of fires in parked BMWs following an ABC News report last week.

Meanwhile, several new consumer complaints from BMW owners reporting similar incidents have appeared in NHTSA's database and on BMW owners' blogs in the past several days.

Calling the 43 fires uncovered by ABC News 'disturbing,' Rosemary Shahan, president of Consumers for Auto Reliability and Safety, said NHTSA should take a serious look at the reports.

'They definitely should,' Shahan said. 'They should be investigating and getting documents from BMW and find out what's going on.'"

Read more:

Consumer advocates urge investigation of mystery BMW fires

"Intersections"

California Treasurer Chiang's Forum

for Exploring California Policy and Politics

"Autonomous Mayhem"

"California's DMV is close to finalizing rules to allow auto manufacturers and tech companies to sell semi-autonomous and fully autonomous cars to consumers.

Reportedly, auto manufacturers, Google, Uber, and other tech companies foresee hundreds of billions of dollars a year in profits. Not just in selling a new generation of vehicles, but also in tracking you, compiling your personal data, and targeting you for marketing as you ride along. Plus the vast cost-savings from eliminating millions of jobs held by drivers and truckers..."

Read more:

"Autonomous Mayhem: Head-to-Head between safety advocate and CEO of Alliance of Auto Manufacturers"

CARS comments to California DMV raises safety concerns about premature deployment of autonomous vehicles

"Ghost cars could be on streets by year's end"

The Sacramento Bee

April 26, 2017

Tony Bizjak

Could you be seeing this car in your neighborhood soon?

"Cars with no one in them may be cruising downtown streets as early as the end of this year if city and state officials have their way.

The state Department of Motor Vehicles plans to issue rules this year that will allow automakers and tech companies to test autonomous vehicles for the first time on public streets with no one behind the wheel...Autonomous car companies complain the rules are too rigid, though, while consumer advocates say the state is [not] looking out enough for public safety....

The tech industry is countered by consumer safety groups. Consumer Watchdog, a Santa Monica-based group, argued this week that proposed DMV rules 'are too industry-friendly and don't adequately protect consumers.' And Rosemary Shahan of Sacramento-based Consumers for Auto Reliability and Safety pointed out that the auto industry has a long history of hiding safety defects on their vehicles."

Read more:

Sacramento Bee: "Ghost cars could be gliding down Sacramento streets by year's end"

"Check for Recalls before You Buy a Used Car"

"New legal settlement means used cars for sale with

safety recalls may become more common"

By Consumer Reports

April 21, 2017

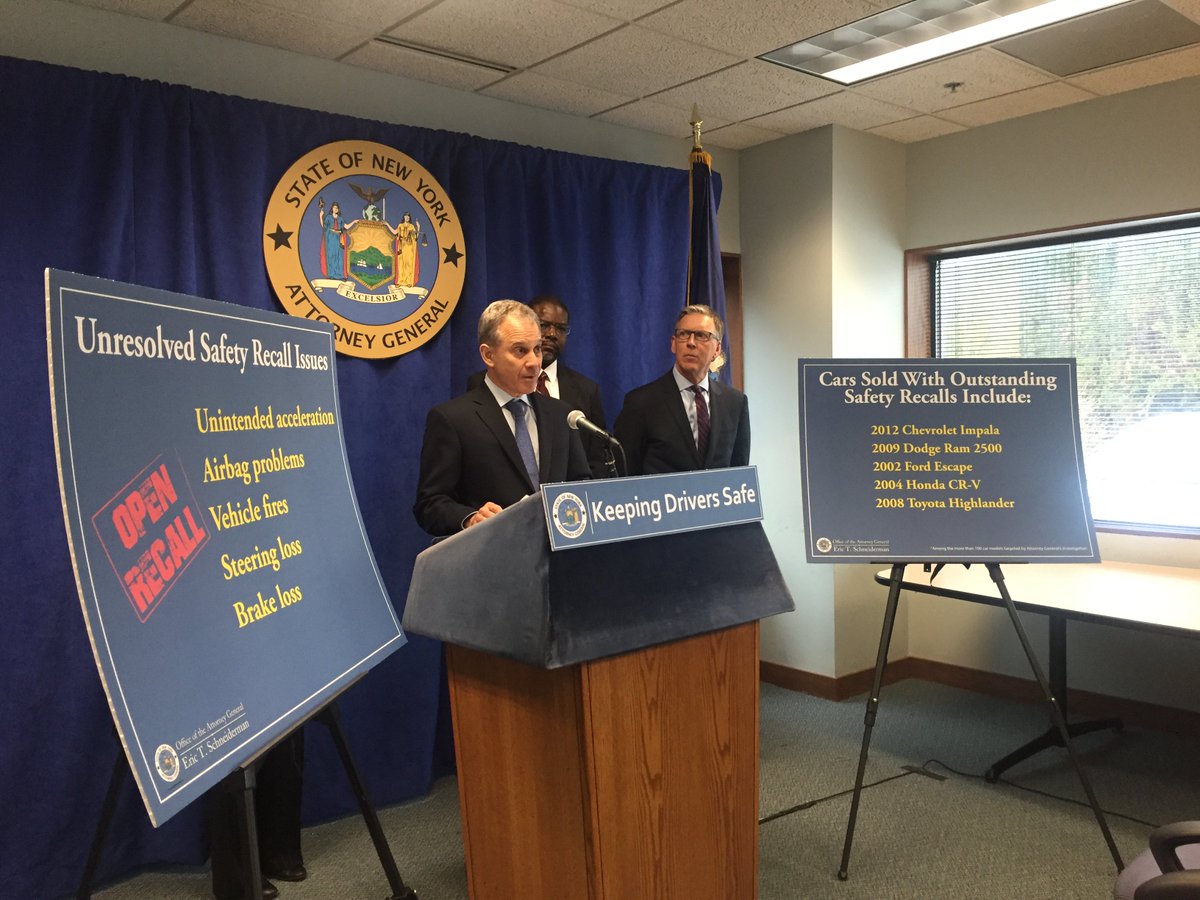

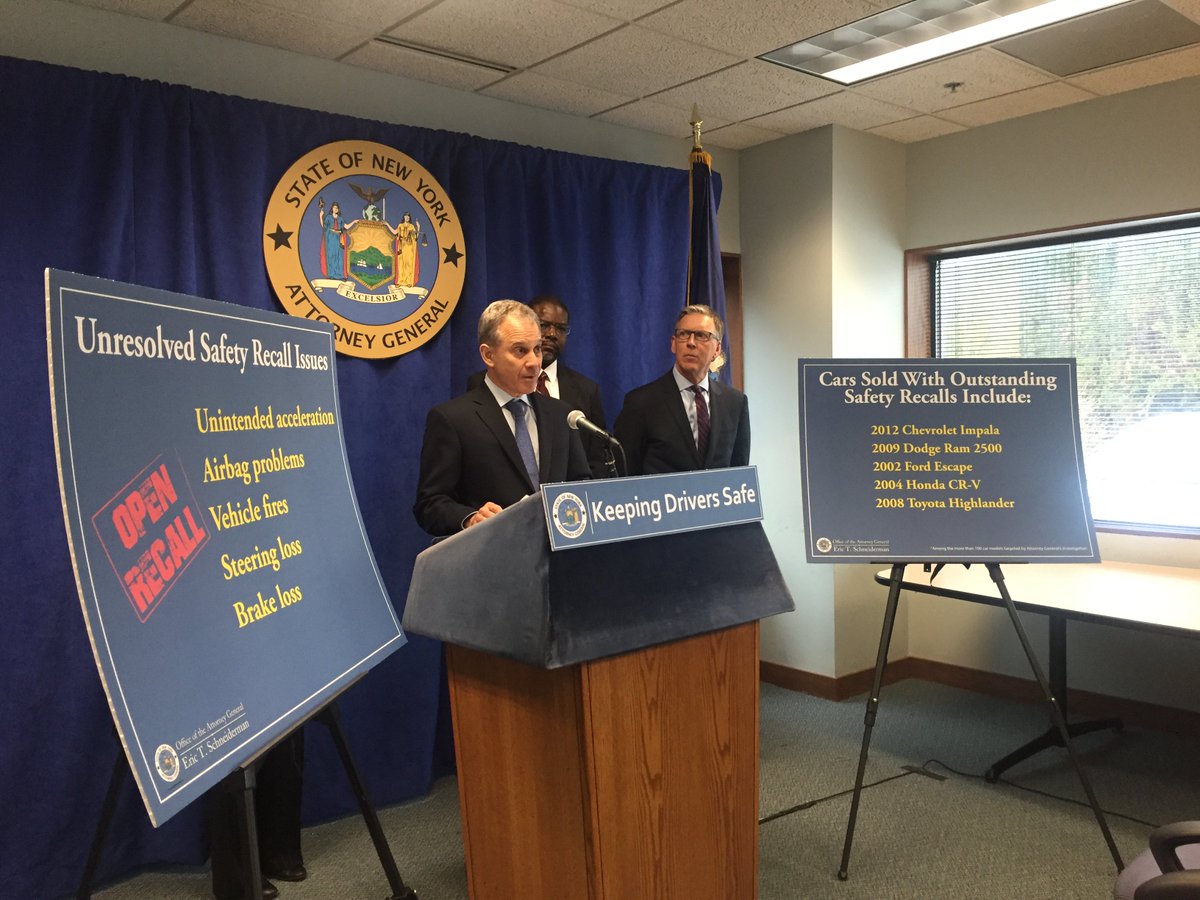

"On Friday, New York Attorney General Eric Schneiderman announced settlements with 104 car dealerships that sold vehicles with unresolved safety recalls without informing the buyers.

New York Attorney General Schneiderman's settlements allow dealers to continue selling unsafe recalled deathtrap cars with "disclosure."

The settlements allow dealers to continue to market and sell used cars with open safety recalls as long as they disclose the issue in their advertising and in showrooms before the sale.

It's the latest wrinkle in a consumer-unfriendly trend that has opened up the sale of more potentially unsafe used cars to the public.

The settlements with the dealerships come weeks after the Federal Trade Commission finalized settlements allowing auto dealer companies to market used cars with unresolved safety recalls, as long as they provide a general statement in advertising that the cars might be subject to a recall.

The FTC settlements from March require used car dealers tell customers how to check for open safety recalls. It's unclear, however, if the FTC will require dealers to disclose open recalls they already know about...

Consumer advocates, who had called for an outright ban on this practice, say that the recent FTC settlements could encourage more dealers to sell cars that are unsafe.

They're allowing car dealerships to mislead buyers about the safety of their cars, says Rosemary Shahan, president of the California-based Consumers for Auto Reliability and Safety, which is suing the agency in federal court. Two other groups are also part of the lawsuit — the Center for Auto Safety and the U.S. Public Interest Research Group."

Read more:

Consumer Reports: New legal settlement means used cars for sale with safety recalls may become more common

"Critics fear Trump will tap auto exec for [National Highway Traffic Safety Administration] NHTSA"

Detroit News

April 24, 2017

By Keith Laing

Could GM CEO Mary Barra be appointed by Trump to head up NHTSA?

"

Washington — Car-safety advocates are worried that President Donald Trump might turn over the keys to the agency charged with regulating the safety of the nation's automobiles to someone from within the industry's ranks.

Rosemary Shahan, president of the Sacramento, Calif.-based Consumers for Auto Reliability and Safety group, said she would not be surprised if Trump reaches out to an auto executive to fill the position of National Highway Traffic Safety administrator, vacant since Trump took office in January.

'He has a penchant of appointing people who have been regulated and allowing them to dismantle agencies,' Shahan continued. 'You have all these companies who have been under investigations for safety violations recently. I wouldn't be surprised if he appointed somebody from one of them. It would be consistent with his other appointments.'"

Read more:

Detroit News: "Critics fear Trump will tap auto exec for NHTSA"

"E-Contract Abuse Alert:

How Car Dealers Can Fake Your Auto Loan"

Forbes

April 14, 2017

By Diana Hembree

"Last December Tanisha Coley was window-shopping at a Kia car dealership in Stamford, Conn., when she decided to fill out a credit application to see whether she had enough credit to buy a car. As a 39-year-old student and mother of five who was working part-time, Coley was in the market for a reliable used auto. After looking around for a while, she left without buying anything. But a few weeks later, Coley was stunned to find her credit report said she had taken out an auto loan of $28,000.

Assemblymember Matt Dababneh (D-Van Nuys) is pushing legislation that would make it easier for crooked dealers and lenders to cheat consumers.

Devastated, Coley began frantically calling the bank and other places to find out what had happened. Getting no answers, she and her fiancé went to the Kia dealership where she had supposedly bought a 2013 Mazda. 'I said, "Well, where's the car?" And they looked really nervous and told me it had been sold to someone else.'

How did Coley end up with a loan for a car she never bought? According to a lawsuit filed on her behalf, the Kia car loan was "electronically booked" on December 12 without Coley's knowledge by Credit Acceptance Corporation, a subprime auto lender with a checkered past. According to the counterfeit installment loan, Coley owed a balance of $17,737, minus insurance payments, an extended warranty and a down payment of $7,000 – none of which she had made.

'I finally got someone at the bank to send me the paperwork,' Coley says, 'and I saw someone had e-signed my name on the loan… It was mind-boggling.'....

E-contracting may be easy and convenient, but it has also generated consumer complaints and lawsuits across the country. Some unethical dealers have used e-contracts to charge more than the agreed-upon sales price, tack on hundreds or thousands of dollars in extra add-ons that consumers didn't want or agree to buy, or overcharge for government fees and engage in other illegal practices – such as e-signing consumers' names without showing buyers the contract.

'Unscrupulous car dealers and shady lenders love e-contracting,' says Rosemary Shahan, president and founder of Consumers for Auto Reliability and Safety (CARS), a Sacramento, Calif.-based non-profit. 'The combination of all-electronic transactions and high-pressure sales tactics at the car dealership, which are aimed at consumers who are often tired and feeling rushed after hours of haggling and test-driving cars, make it much easier for dealers and crooked lenders to get away with fraud, forgery and other flim-flam.'

Experts say e-contracting abuses are rampant in Spanish-speaking communities...

'Auto loans are now the most troubled consumer financial product,' said Sen. Elizabeth Warren (D-Mass) in a speech last spring. 'The market is now thick with loose underwriting standards, predatory and discriminatory lending practices, and increasing repossessions.'...

Despite its perils, auto sale e-contracting continues to grow and may even be coming to California. The California New Car Dealers Association is pushing for the passage of Assembly Bill 380, which would allow e-contracting during auto sales in California.

The bill, sponsored by Matt Dababneh (D-Van Nuys), is opposed by Consumers for Auto Reliability and Safety, CALPIRG, Consumer Action, the Center for Responsible Lending, the Consumer Federation of California, and the Public Law Center, among other [consumer and economic justice organizations]."

Read more:

Forbes: "E-Contract Abuse Alert: How Car Dealers Can Fake Your Auto Loan"

One of the biggest winners would be Credit Acceptance Corp. What's their business model?

Mother Jones: "They Had Created this Remarkable System for Taking Every Last Dime from Their Customers: Welcome to the Lucrative, Predatory World of Subprime Auto Loans"

Here's why pro-consumer groups that work on behalf of consumers and against powerful, crooked special interests are opposing AB 380:

Large coalition of pro-consumer, pro-economic justice organizations opposes AB 380

Consumers for Auto Reliability and Safety opposes AB 380 (Dababneh)

Consumer Federation of California

CALPIRG

Public Counsel

Consumer Federation of America

Attorney David Valdez, who represents many victims of unscrupulous auto dealers and lenders

"Is Your Used Vehicle a Timebomb? Loophole Lets Auto Dealers Sell Millions of Recalled Cars as 'Safe'"

Forbes Magazine

by Diana Hembree

March 27, 2017

"Consumer advocates have been pushing to close the loophole that makes this possible. The fight intensified this February, when six consumer groups sued the [Trump Administration] Federal Trade Commission (FTC) over a consent order involving General Motors and two of the country's largest auto dealers. The FTC had issued complaints against the three for failing to disclose that their used cars were recalled for safety problems that were never fixed. In its December 2016 consent order, the FTC allowed the companies to continue selling used cars that were recalled and never repaired as "safe" or "certified" – as long as they disclosed that the recall repairs had not been made.

FTC would allow dealers to advertise recalled cars with lethal safety defects, including catching on fire, as "safe."

Auto safety advocates lambasted the FTC's decision.

'The consent order is crazy; it's insane,' says Rosemary Shahan of Consumers for Auto Reliability and Safety (CARS), one of the consumer groups suing the FTC. 'It lets car dealers put death traps on the road. It's worse than nothing because it actually gives car dealers a safe harbor if they sell a used and recalled car that hasn't been fixed.'

....All the major car manufacturers had previously forbidden their dealers to sell used cars with unfixed recalls, says Shahan, but after the consent order Ford reversed gears and began selling them.

And Trump's presidency makes it even less likely these loopholes will be closed, as the case of AutoNation suggests. AutoNation, the country's largest car dealership, had pledged not to sell vehicles with open recalls, but, quietly backpedaled after Trump's victory and resumed sales of vehicles with open recalls. According to Automotive News, CEO Mike Jackson concluded the change in government meant the death knell for legislative action on used vehicles with open recalls."

Read more:

Forbes: "Is Your Used Vehicle a Timebomb? Loophole Lets Auto Dealers Sell Millions of Recalled Cars as 'Safe'

"Very Safe, Except for One Thing...

Legal Clash with FTC on Marketing of Used Cars"

Fair Warning

by Paul Feldman

March 27, 2017

"Can a used car be marketed as 'safe' or 'certified' even if it has defective air bags, a faulty ignition switch or other potentially lethal problems?

FTC would allow dealers to advertise cars are "safe" when they have killer safety defects that have not been repaired.

Yes, so long as the used car dealer discloses that the vehicle may be subject to a pending safety recall.

That stance, taken by the Federal Trade Commission, is at the heart of a recent legal settlement with General Motors and two used car dealers over deceptive advertising practices. But it is now being put to the test in a federal court in Washington, D.C., by auto safety activists....

'The sale of "certified" used cars as "safe," "repaired for safety issues," or "subject to a rigorous inspection," when such vehicles are in fact not safe because they are the subject of pending safety recalls, is extremely detrimental to consumers who buy used cars—particularly poor, unsophisticated, and non-English speaking consumers,' declared the Center for Auto Safety and other safety groups involved in the case....

Under the consent order, the agency said dealers who market a vehicle as safe must have completed repairs on recall issues or disclosed clearly that the vehicle [may remain] subject to an open recall.

That, however, can amount to a 'death sentence' for used car buyers who unwittingly purchase vehicles with unrepaired recalls, while also posing a direct threat to others on the road, said Rosemary Shahan, founder of Consumers for Auto Reliability and Safety, one of the advocacy groups involved in the new legal challenge."

Read more:

Fair Warning: "Very Safe -- Except for One Thing"

"FTC Sued for Allowing Car Dealers to Sell Recalled Vehicles with Potentially Lethal Defects"

NBC News

by Herb Weisbaum

Jewel Brangman was just 26 years old when she was killed by a recalled Honda Civic with an unrepaired Takata airbag. More innocent people will die unless we stop the FTC and keep dealers from advertising these cars as "safe."

"Why are dealers still selling cars with unrepaired — and potentially fatal — safety recalls?

Consumer advocates are outraged by the Federal Trade Commission's decisions in several recent cases that allow car dealers to advertise used vehicles with open recalls as safe.

Last year, the FTC reached legal agreements with General Motors and two car dealers who had advertised how rigorously they inspected their cars, but failed to disclose that some of those "certified" or "inspected" vehicles were subject to unrepaired safety recalls.

According to the complaint, some of those open recalls could cause serious injury from issues such as faulty ignition switches and airbags, problems with the power steering and braking, and alternator problems that could result in a fire.

Everyone else in this fender-bender walked away. Jewel Brangman bled to death because she was driving a Honda Civic with an unrepaired Takata airbag. The rental car company, like many dealers, failed to get it repaired before handing her the keys.

As part of the settlement, the commission decided the dealers could claim used vehicles with unfixed recalls are "safe" or have been subject to "a rigorous inspection," as long as they disclosed that those recall repairs were not made. GM and the car dealers did not admit any wrongdoing.

Last week, the Center for Auto Safety, Consumers for Auto Reliability and Safety, and the U.S. Public Interest Research Group sued the FTC, asking a federal court to review and overturn these consent agreements.

It's Not 'Safe' If It Is Potentially Lethal

"It's a dangerous and irresponsible abuse of the commission's authority," said Rosemary Shahan, president of Consumers for Auto reliability and Safety (CARS). "Instead of protecting consumers, the FTC is allowing false and deceptive advertising. A vehicle cannot be safe when it has a potentially lethal safety defect that hasn't been fixed."

Read more:

NBC News: "FTC Sued for Allowing Car Dealers to Sell Recalled Vehicles with Potentially Lethal Defects"

"New lawsuit could force used car dealers to repair recalled vehicles"

The Washington Post

by Richard Read

February 8, 2017

"Recalls have been making headlines for the past several years, but on used car lots, recalled vehicles aren't always easy to spot. That could change thanks to a new lawsuit filed against the U.S. Federal Trade Commission...

....massive retailer AutoNation saw the writing on the wall and announced big plans to repair all recalled vehicles before rolling them into showrooms. A year later, though, AutoNation abandoned that program: not only was repairing vehicles costing the company in lost sales, but CEO Mike Jackson also cited Donald Trump's win in the U.S. presidential election as a sign that legislative efforts to mandate repairs of used cars would stall.

CARS sues to stop dealers from advertising cars with defects, like this Honda with a recalled Takata air bag, that blinded Stephanie Erdmann, as "safe."

And stall they have. As a result, consumer groups like Consumers for Auto Reliability and Safety, the Center for Auto Safety, and the U.S. Public Interest Research Group have filed a lawsuit against the FTC....

Generally speaking, automakers forbid dealerships from advertising vehicles as "certified pre-owned" unless they've been through rigorous inspections and repaired for any safety problems. However, Ford recently told dealers that they can advertise vehicles as "certified", as long as (a) they don't include the word "safe" in their advertising, and (b) they have buyers sign waivers to indicate that they're aware the vehicle they're purchasing may be unsafe....

Even in today's contentious political climate, when everything is spun for maximum effect, words still mean things. If a car is listed as "certified pre-owned", it implies certain benefits, certain things that consumers can take for granted. Shifting the definition of the phrase is potentially hazardous to consumers' health. On that argument alone, the plaintiffs would seem to have a strong case.

On the other hand, the courts have a long history of believing in the principle of "caveat emptor": buyer beware. The court could cite such precedents and side with the FTC.

We're not lawyers or judges, so we won't comment on the likelihood of one verdict versus another. But we'll do our best to keep you posted."

Read more:

Washington Post: "New lawsuit could force used car dealers to repair recalled vehicles"

"How to Buy a Used Car in an Age of Widespread Recalls"

New York Times

January 27, 2017

By Ron Lieber

"For people in the market for a used car, the "certified pre-owned" designation has long been the gold standard, an indication that a qualified mechanic has vouched for the car and that a buyer can expect a vehicle that is - hopefully - almost as good as new.

But the Takata airbag recall, which is the biggest in history, has upended all of that. Now the certified designation - known in the auto trade as C.P.O. - will no longer necessarily have the same meaning. For one thing, last month the Federal Trade Commission made it easier for cars to be billed as "certified," even if they were under recall and hadn't been fixed yet.

Ford allows its dealers to sell cars with killer Takata airbags as "certified" and charge extra for them

And just as significantly, Ford - with the F.T.C. settlement for cover - told its dealers this week that they could sell recalled vehicles and certify them too, so long as they did not advertise them as "safe" and required buyers to sign forms acknowledging that they were aware of the problem.

Against this backdrop, one dealer in Florida has refused to sell recalled vehicles that he cannot get fixed, letting 100 or so pile up on a lot miles from his main showroom. He even sued a rival who he believes is selling recalled cars without disclosing that they have not been fixed yet....

"...the Federal Trade Commission told General Motors and two dealers in December that it was just fine to advertise used vehicles as certified even if their airbags were under recall and had not been fixed. Just disclose it, the agency said (in a complaint that has sent jaws dropping throughout the auto industry). [And among auto safety advocates, who have been actively opposing the FTC's proposed agreements.]

The used-car chain CarMax has taken a similar approach to Ford's. While it too had a recent run in with the F.T.C. over disclosure issues, the company says that it is transparent as possible, from its online listings to its in-person interactions.

But why sell cars with open recalls at all, thus putting the onus on consumers to sort out the repair....

AutoNation [the largest new car dealership chain in the U.S.] took a different approach, at least at first. In 2015, its chief executive, Mike Jackson, told Automotive News that the recall situation was "a dysfunctional nightmare that the industry should be ashamed of." The company pledged to sell no cars with open recalls, period.

By last year, it was costing the company dearly, to the tune of 6 cents per share of its earnings in the third quarter. In November, it gave up and began selling some cars with open recalls (and full disclosures). The lack of Takata airbag replacements, the F.T.C.'s decision and other anticipated regulatory rollbacks proved to be too much....

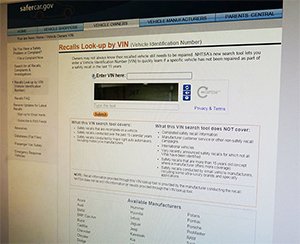

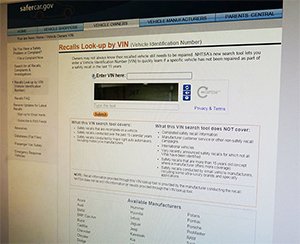

Worried about a car that you already have? You should be, both about future Takata recalls and others that we don't know about yet. Rosemary Shahan of the Consumers for Auto Reliability and Safety suggests registering your vehicle both with your car's manufacturer and the National Highway Traffic Safety Administration so that you get a notice if your airbag or anything else comes up for recall. Run the vehicle identification number through some checks yourself from time to time too, just to make sure you're not missing anything.

You might also hope that more dealers act out in the same way as Earl Stewart of Lake Park, Fla. He refuses to sell used cars with open recalls, but he doesn't want to turn away people who are trading in cars with recalled Takata airbags that they have not been able to get fixed yet. This trade-in policy isn't just good customer service; if he can't take their trade, they might not buy another vehicle from him at the same time that they turn their old one in.

As a result, however, he has 100 or so cars sitting in a lot waiting for repair. And when he sent secret shoppers into competing dealers to see how much disclosure they were doing about recalled cars they were selling, he was outraged at what he found. "Maybe this is unique to South Florida, but they are all extremely devious and proactively trying to sell recalled cars by saying there is no recall," Mr. Stewart said.

So he filed a lawsuit to try to swing others over to his way of doing things. 'I don't want the money - I just want to stop the practice,' he said. 'We're going to keep filing suits until they throw the towel in.'"

Read more:

New York Times: "How to Buy a Used Car in an Age of Widespread Recalls"

CarMax, others settle US Actions over Used Car Safety

The Associated Press

Published in the New York Times

December 16, 2016

"A consumer group criticized those agreements as failing to protect car buyers and actually harming consumers. By permitting the companies to disclose that cars may be subject to recalls, the FTC is allowing them to advertise that recalled and unrepaired used cars are safe and have been 'repaired for safety,' Consumers for Auto Reliability and Safety said in a statement. The consent orders may lower the standard for the industry in this type of advertising and are weaker than state laws, the group said."

Read more:

AP report, published in New York Times: CarMax, others settle US Actions over Used Car Safety

"Trump Appointments: Is a Step Back for Auto Safety Looming?"

Forbes Magazine

December 13, 2016

by Cheryl and Christopher Jensen

"As President-elect Trump pieces together his administration, consumer advocates are wondering who will head up the National Highway Traffic Safety Administration – a crucial position when it comes to automotive safety. That position is now held by Mark Rosekind, who got the job in December 2014.

Dr. Mark Rosekind, Administrator, National Highway Traffic Safety Administration

One can make a good argument that Rosekind has been the most aggressive, pro-consumer administrator in years. It's been a startling and happy change for an agency that has had a relationship with the auto industry routinely criticized by consumer advocates as cozy and accommodating.

'He deserves enormous credit for pressuring manufacturers to perform record numbers of safety recalls and to take a more pro-active approach to addressing safety defects,' says Rosemary Shahan, the president of Consumers for Auto Reliability and Safety...

Under [former NHTSA Administrator David Strickland], safety advocates said N.H.T.S.A. continued as a captive of the auto industry and Strickland showed little interest in breaking free...

The decision on whether to replace Rosekind is expected to be made by Elaine Chao, who has been selected to head up the Department of Transportation. The N.H.T.S.A. is part of that department."

Note: Elaine Chao is married to Republican Senate Majority Leader Mitch McConnell. Since 2011, she has been serving on the Board of Directors of Wells Fargo, which has been caught engaging in numerous illegal practices, including creating bogus accounts through fraud and identity theft, overcharging over $203 million in overdraft fees, and illegally repossessing cars from military Servicemembers serving our nation on active duty.

Read more:

Trump Appointments - A Step Back for Auto Safety?

"Deadly Airbags are Still on the Road"

KOVR-TV (CBS, Sacramento)

November 18, 2016

By Kurtis Ming

ELK GROVE (CBS13) – The Takata airbag recall is so huge that carmakers can't get all the vehicles on the road fixed right away. And with the reported deaths, Elk Grove couple Judi and Jim Braddy say they don't want to drive their 2013 Volkswagen Golf in the meantime. Judi says her Golf doesn't see much time on the road these days.

'If I drive it at all, it's just to the store and back,' said Judi.

It has been recalled over its Takata airbag, just like 29 million other cars tied to 14 carmakers. The airbag issue is now blamed for 11 deaths and more than a hundred injuries. "They have no idea when the part is going to be available," said Judi. With seven months left on their lease, Judi and Jim just want it fixed or want to trade in their Golf early. 'My biggest fear is that something could happen to my wife or…granddaughter,' said Jim.

We reached out to Rosemary Shahan, President of Consumers for Auto Reliability and Safety to get an idea of the size of this recall. 'This is a huge problem for consumers who can't get their cars fixed,' said Shahan. She says with the massive repair backlog, anyone who feels unsafe should demand a loaner car. But what if the car company says refuses? Shahan says, 'I wouldn't take no for an answer.'

But that didn't work for the Braddys; they say Volkswagen refused to provide a loaner car...."

See the full report:

KOVR TV: "Deadly Airbags are Still on the Road"

Note: If you have a recalled car with a Takata air bag and the manufacturer refuses to provide a loaner car, consider renting a safe car and seeking reimbursement for the expenses, either by taking the manufacturer to small claims court or obtaining legal counsel. The National Association of Consumer Advocates lists attorneys who specialize in representing consumers in auto warranty and fraud cases. Some attorneys have succeeded in obtaining relief for clients stuck with unsafe recalled cars, who are facing lengthy delays for repairs.

"Local Military Veteran Says Car Dealership Selling Unregistered Cars"

ABC Channel 10, San Diego

November 11, 2016

By Melissa Mecija

"SAN DIEGO - A local military veteran saved his money to buy a used car only to find out it is not his at all.

Michael Bentley served in the Navy and was stationed in San Diego. He told Team 10, 'I lived out here when I was in the military; loved it out here.' Bentley moved back to San Diego for a new job. He knew he needed a car, so he went to Quality Auto Group on Miramar Road to buy one.

'It's a 2010 Nissan Altima. I liked it because it had a nice four-cylinder [engine],' Bentley said.

He had no issues at first, but a few months later, he was pulled over for having an unregistered vehicle. Bentley has been pulled over twice so far and has had to pay a couple hundred dollars' worth of tickets. His temporary tags had expired. Bentley was waiting for his permanent license plates and registration from Quality Auto Group, but they never came. Bentley called the business several times, but he could not get a hold of anyone. He later learned Quality Auto Group went out of business, leaving him with unanswered questions.

'I don't want to be driving an illegal car,' Bentley said.

Bentley later learned the Nissan he bought also had an outstanding lien. His lawyer told Team 10 the dealership did not have clear title and never properly registered the car with the DMV, which is a violation of the vehicle code.

'I pretty much have a $17,000 paperweight,' Bentley told Team 10. Team 10 went to an address listed for the dealership owner, Manouchehr Sorbi. Nobody answered the door and the front room looked empty, except for a dog inside.

Consumer advocate Rosemary Shahan said it is far too easy for small dealerships like Quality Auto Group to disappear and reappear. 'Very often, they just start up under another relative's name so they go in and out of business over and over again,' said Shahan, president of Consumers for Auto Reliability and Safety. Shahan recommends shoppers looking for a used car ask to see the actual title and double check it with the DMV. Bentley plans to file a civil lawsuit. He is sharing his story so others will not have to deal with a similar predicament.

A DMV spokesperson confirmed there were three cases against Quality Auto Group, but did not go into detail. Those cases are now closed, and the DMV could not talk about Bentley's case because it is an open investigation."

Watch the full report:

ABC Channel 10 (San Diego): Military Veteran says Car Dealership Selling Unregistered Cars

"Used Cars Slip Past Recall Safeguards,

Putting Drivers in Danger"

New York Times

October 26, 2016

by Rachel Abrams and Hiroko Tabuchi

"Ms. Robles's son, Jose Contreras, 26, bought his mother's car a year ago from Ivan Henderson, a man he met playing pool.

Last month, during a fender-bender, the car's airbag exploded, propelling metal parts that killed Ms. Robles, who worked the 5 a.m. shift as a breakfast attendant at a Hampton Inn.

'She was my best friend,' Mr. Contreras said of his mother, in text messages, from his home in Riverside. 'Her grandkids were her world.'....

Safety advocates say that Mr. Henderson and the sellers before him should never have sold a recalled car without disclosing the defect or getting the airbag replaced at a Honda dealer at no cost to the owner...

Despite the lack of explicit federal laws on recalled used cars, a patchwork of state consumer protections and laws already effectively prohibits the sale of dangerous vehicles, some safety advocates and lawyers say.

"Anytime they conceal a material defect, that's fraud," said Rosemary Shahan, the president of the nonprofit Consumers for Auto Reliability and Safety.

New York State, for instance, forbids the sale of vehicles "as is." The New York City Department of Consumer Affairs says cars offered for sale must be "roadworthy," and it has gone after dealers it suspected of selling cars that were recalled but not repaired.

Some companies like CarMax, one of the country's largest used-car dealers, advertise that their vehicles pass rigorous safety tests — even if the cars have unrepaired problems for which recalls have been issued. CarMax says it discloses recalls.

Still, Ms. Shahan and others argue, advertising a recalled vehicle as safe is misleading."

Read more:

New York Times: "Used Cars Slip Past Recall Safeguards"

Buying at a Used Car Auction?

What You Don't Know Can Kill You

The New York Times

October 26, 2016

by Rachel Abrams and Hiroko Tabuchi

"On Tuesday, two reporters from The New York Times visited a car auction held in Queens by the New York City Department of Finance.

It was a lesson in how consumers can purchase cars that have deadly defects and how sellers have few obligations to disclose those defects to the public....half of the cars had been recalled for various reasons, including faulty ignition switches and Takata airbags, which between them have killed or injured hundreds of people worldwide.

Unlike new cars, used cars have no federal requirement that sellers disclose safety recalls or fix dangerous defects, although some state and local regulations offer consumers some protections.

But enforcing those protections can be tricky, and sometimes happens only after someone has been harmed, requiring lawsuits for wrongful death or negligence.

That is why safety advocates like Rosemary Shahan, the president of the nonprofit Consumers for Auto Reliability and Safety, have been pushing for laws that specifically ban the sale of recalled vehicles in which repairs have not been made.

'It's illegal for a dealer to knowingly or negligently sell an unsafe car,' Ms. Shahan said. 'It's a question of, how many layers of enforcement can you add?' "

Read more:

NY Times report "Buying at a Used Car Auction?"

"Sacramento workshop brings future of self-driving cars into focus"

The Sacramento Bee

October 9, 2016

By Mark Glover

"Advocates and even critics of self-driving cars agree that they will someday be part of life in California. Just how soon that happens and what form autonomous vehicles take will likely be determined to some extent in Sacramento just a week and a half from now. The California Department of Motor Vehicles' revised draft regulations for autonomous vehicles will be open to public comment at an Oct. 19 workshop...

Rosemary Shahan, president and founder of the Sacramento-based Consumers for Auto Reliability and Safety, said that would unfairly place liability on the 'driver,' when the onus should fall to the automakers developing the technology. She also said there should be driver training in the event of an autonomous vehicle failure and what to do if the electricity grid goes down."

Read more:

Sacramento Bee: DMV workshop on future of self-driving cars

Toyota case tests warranty limits for military families

Automotive News

By Sharon Silke Carty

August 28, 2016

WSB-TV 2 Atlanta: Toyota sues military family, after selling them unsafe lemon RAV4

"The case, which heads to the Superior Court of Georgia for trial early next year, has prompted a consumer advocacy group to lobby for a law that would force companies to adhere to their warranty promises even when products are taken overseas by members of the military on active duty. Rosemary Shahan, president of Consumers for Auto Reliability and Safety, said she and the Snells have been in talks with the U.S. Senate Committee on Commerce, Science and Transportation about creating legislation that would guarantee military members on active duty would get warranties honored.

Shahan pushed for a similar law that was passed in 2007 in California that protects military service members under California's lemon laws, even for a vehicle purchased outside California. That's important for military service people, who move every two to three years on average.

Flinn said he hopes there will be political willingness to pass a similar law that covers overseas deployments.

He said, 'We need to get something done to make sure the warranties follow servicemen overseas.'"

"Are safety regulators finally going to help victims of geographic recalls?"

Forbes

Sept. 12, 2016

by Christopher Jensen

Ford expands recall over faulty door latches that can fly open

"To the agency's credit this is the second time this year that N.H.T.S.A. has expanded a regional recall. Earlier this year it required the deadly Takata airbag recall to go national, although some consumer advocates say that was a no-brainer.

So, could N.H.T.S.A. suddenly be paying more attention to regional recalls and generally getting tougher on the automakers?

Some consumer advocates think that's possible due to the influence Mark Rosekind, who was appointed late in 2014 by President Obama to take over an agency with a reputation among consumer advocates for being too accommodating to the auto industry at the expense of consumers.

Under Rosekind the agency has been more aggressive and tougher, says Rosemary Shahan, the president of Consumers for Auto Reliability and Safety.

But, she says, N.H.T.S.A. should never have been allowed Ford to recall only 767,000 of those vehicles in the first place.

Read more:

"Forbes: Ford expands safety recall"

"Congressman offers unusual defense in ethics probe"

Williams, a car dealer, says he wasn't helping himself,

he was helping a lobbyist for car dealers

Center for Public Integrity

September 13, 2016

By John Dunbar

"U.S. Rep. Roger Williams, a Texas Republican under investigation by the House Ethics Committee, asserts that he did nothing wrong when he offered an amendment that would benefit car dealers — despite the fact that he himself is a car dealer.

Members of Congress, say the rules, may not use their positions for personal financial benefit. But Williams asserted in a statement that he did not profit from his actions.

GOP Rep. Roger Williams, a Texas car dealer, faces House ethics investigation

Instead, Williams revealed, he offered the amendment at the behest of a lobbyist. And the lobbyist — whose employer, the National Automobile Dealers Association, one of the congressman's top donors — was even kind enough to send along 'proposed language' for the text of the amendment.

The case is being considered by the House Ethics Committee. There is no timetable for when the committee will rule. But regardless of what happens, the Austin area congressman's defense offers a rare glimpse at how business is often done in the Capitol.

In this case, at least, it reveals a place where lobbyists have enormous influence; where a legislator was arguably more concerned with his own interests and those of his donors than his constituents; and where actions that appear at first glance to be clear conflicts of interest, are in fact, routine...

Rep. Williams offered an amendment on the floor of the House just before midnight on Nov. 4 that alleviated the dealers' concerns. It would, as understood by Williams and NADA, carve out an exemption for auto dealers. It would, in effect, allow them to rent or loan out vehicles even if they were subject to safety recalls...

'It seems to me that if it isn't illegal, if it isn't an ethics violation it ought to be,' said Shahan, president of Consumers for Auto Reliability and Safety, a [non-profit] consumer group. 'His amendment benefits nobody but car dealers. And he's a car dealer.'

In his statement, Williams says that his business does indeed offer rental cars for use by customers who are getting their vehicles fixed as well as loaner cars...Williams, in his defense, said he sometimes loses money under the arrangement and that the passage of the amendment would have "zero bearing" on his business interests.

Shahan said dealers still benefit indirectly.

'They benefit, of course, by profiting from having the repair business,' she said. 'And you can be sure that it's built into the price they charge for the repair.'

Shahan said it was clear that the congressman was not interested in consumers.

'It doesn't get any clearer that he was not acting in the public interest, he was acting in the interest of the NADA members. He doesn't even claim to be acting in the public interest,' she said."

Read more:

Congressman Roger Williams faces ongoing ethics probe

CARS Praises Consumer Financial Protection Bureau for

Helping Improve the Economy and Protect Consumers,

Especially Military Servicemembers and their Families

Richard Cordray, Director of the Consumer Financial Protection Bureau, and CARS President Rosemary Shahan, a fellow Buckeye

At a roundtable and Field Hearing in Sacramento hosted by the Consumer Financial Protection Bureau, CARS President praised CFPB Director Richard Cordray and his team for helping improve America's economy and protect consumers, especially military Servicemembers and their families. At the roundtable, Shahan also provided information about predatory lending practices perpetrated by "Buy Here Pay Here" car dealers, who commonly overcharge vulnerable car buyers who are desperate for wheels to get to work for junky cars that break down soon after purchase. Some don't even make it home from the car lot.

The dealers typically also charge exorbitant interest rates on loans that vastly exceed the value of the cars. When the cars break down, the car buyers lose their only means of transportation to get to work, costing them their jobs. When they default on their loans, the dealers repossess the cars, and then resell them again and again. Each time, they make a high profit.

As reported in an award-winning series by

Los Angeles Times reporter Ken Bensinger, some dealers make this predatory practice, known as "churning," a regular business practice. Too often, California's Department of Motor Vehicles fails to protect car buyers from such practices. Even if dealers are closed by the DMV, or declare bankruptcy, they often re-open again, sometimes in the exact same location, under a relative's name, and continue to engage in the same illegal conduct.

What happens when you can't get your car registered?

NBC Bay Area report

"Dealer can't register car. Woman wants refund."

July 19, 2016

by Chris Chmura, Christine Roher, and Joe Rojas

"Dori Hess sums up her situation in a made-for-TV sound bite. 'I bought a car I can't drive,' she said. Mechanically speaking, her new car is perfect. But legally, it's not drivable.

Hess bought a 2011 Acura TSX for about $18,000 in September [over 8 months ago]. 'I paid for it in full,' she said. And yet, the car is still unregistered. What's the hold up? The dealer. Hess says AutoNation Acura of Stevens Creek agreed to title and register the TSX for her. Her paperwork even lists a $29 service fee. But the dealer hasn't titled or registered the car. The expired plate is proof....Hess's Acura is screaming for a ticket.

'The DMV investigator told me I could be pulled over, and the car could be towed,' Hess said. Hess said the dealer didn't offer an explanation; it was stalling....

Rosemary Shahan, the consumer advocate who leads Consumers for Auto Reliability and Safety, is lobbying the Legislature to give drivers a break when dealers are careless with paperwork. 'You get penalized if they don't do their job,' she said."

NBC Bay Area report:

"Dealer can't register car. Woman wants refund."

Unless Governor Brown vetoes a bill (AB 516) that is being backed by toll authorities and the California New Car Dealers Association, more innocent car buyers like Dori will be unfairly penalized when dealers sell them cars they cannot get properly registered, through no fault of their own.

Read more:

Can't get your car registered? Stopped by Police? You are not alone.

"Car Dealer-Congressman Subject of Ethics Probe"

"Republican Rep. Roger Williams submitted

amendment that would benefit his business"

Center for Public Integrity

June 28, 2016

By John Dunbar

"The [United States] House [of Representatives] Ethics Committee has revealed it is investigating the conduct of U.S. Rep. Roger Williams, R-Texas, a Weatherford car dealer who authored an amendment that would have exempted his industry from a safety requirement and benefited his own business.

Williams' apparent conflict of interest was first reported by the Center for Public Integrity in November and led to a formal complaint being filed by the Campaign Legal Center, a Washington, D.C. legal watchdog.

U.S. Rep. Roger Williams, a car dealer, adds car dealer loophole to Rental Car Safety Act.

In a brief press release, the House Ethics Committee announced Monday that it had "decided to extend the matter regarding" Williams, which was "transmitted to the committee by the Office of Congressional Ethics on May 13, 2016."

The Office of Congressional Ethics is a nonpartisan organization that vets complaints against members. The press release revealed for the first time publicly that the claims of misconduct leveled against Williams were under review by the House Ethics Committee.

The amendment was proposed as part of a broader transportation bill. Offered just before midnight on Nov. 11, 2015, it would have allowed automobile dealers to rent or loan out vehicles even if they were subject to safety recalls. Rental car companies, meanwhile, wouldn't get the same treatment. The measure passed the House of Representatives but after the Center wrote about it, the Williams proposal died in the conference process between the House and the Senate....

A spokesman for the House Ethics Committee declined comment. Punishment for violating House rules can include a formal reprimand, censure or even expulsion. Each action would require a vote of the full House.

Rosemary Shahan, president of Consumers for Auto Reliability and Safety, a group that advocates for vehicle safety, was highly critical of Williams' conduct. Shahan said she hopes the news of the committee's review 'sends a message that lawmakers should be representing the public and not their own personal interests.' "

Read more:

Center for Public Integrity report: Car Dealer Congressman Subject of Ethics Probe

News release:

issued by U.S. House Ethics Committee

"Takata airbag recalls continue to hit dealerships"

Roanoke Times

June 5, 2016

by Tiffany Holland

"... Rosemary Shahan, the founder and president of California-based Consumers for Auto Reliability and Safety...said the first thing someone should do before buying a car is check its vehicle identification number, or VIN, and make sure it's not under a recall. Car owners who receive a recall notice should make an appointment to get their vehicle repaired as soon as possible and shouldn't assume that everything's OK just because they've been driving a car for many years without a problem.

'You just don't know,' she said. 'It's risky.'

If there is a wait list to get a car repaired, Shahan suggests asking for a loaner car to use until the parts are available. Some dealerships will provide one at no charge in this situation.

'All recalls you need to take seriously and this is no exception,' she said."

Read more:

Roanoke Times: Takata recalls continue to hit dealerships

"America's Safety Recall Crisis:

Consumers Catch Some of the Blame, Too"

NBC News

June 2, 2016

by Paul Eisenstein

"In barely a month, more than 16 million vehicles using dangerously defective Takata airbags have been recalled, 4.4 million on Thursday alone. On top of the 24 million vehicles impacted by an earlier service action involving Takata, it's the biggest recall in automotive history.

But it's just one of the reasons why automotive safety recalls, in general, have hit record numbers two years in a row, with some observers worrying that 2016 could bring yet another all-time high. It's not just that so many dangerous defects are being uncovered that worries safety advocates most, however, but the fact that as many as one in five vehicles on U.S. roads have at least one unrepaired problem covered by a recall....

This week, the Rental Car Safety Act — inspired by the 2004 deaths of sisters Raechel and Jacqueline Houck — went into effect and now requires rental car companies to pull recalled vehicles out of their fleets until defects are fixed.

Similar efforts targeting car dealers have been stalled on Capitol Hill, however — though the nation's largest new car retail chain, AutoNation, now voluntarily halts sales until vehicles on its lots are repaired....

'The responsibility for the huge numbers of recalled cars lies squarely with the manufacturers and suppliers, who concealed defective, unsafe products,' not consumers, said Rosemary Shahan, an advocate with the California-based Consumers for Auto Reliability and Safety.

And she calls on Congress to provide more funding to NHTSA to crack down on the industry and find problems sooner."

Read more:

NBC News: "America's Recall Crisis"

Growing Momentum for Self-Driving Cars Worries Safety Advocates

Fair Warning

June 2, 2016

by Brian Joseph

On Valentine's Day in Silicon Valley, one of Google's experimental, self-driving cars sideswiped a city bus at 2 miles an hour. The incident marked the first time an autonomous car contributed to an accident on a public road, but did nothing to diminish the Obama administration's enthusiasm for driverless vehicles.

Some auto safety advocates fear the government is embracing the technology too quickly without assessing its actual capabilities and practical implications. With billions of dollars at stake and aggressive lobbying by the tech and automotive industries, safety advocates fear that regulators will allow themselves -- and the public -- to be steamrolled in the name of progress and innovation.

But some automotive safety advocates fear government is embracing the technology too quickly without carefully assessing its actual capabilities and practical implications. With billions of dollars at stake and aggressive lobbying by the tech and automotive industries, safety advocates worry that government regulators will allow themselves – and the public – to be steamrolled in the name of progress and innovation.

Rosemary Shahan, the founder and president of Consumers for Auto Reliability and Safety, is concerned that autonomous cars are not ready for the road.

"These cars are not ready for prime time," said Rosemary Shahan, the founder and president of

Consumers for Auto Reliability and Safety, a Sacramento, Calif.-based advocacy organization best known for spearheading passage of the state's automobile lemon law.

Autonomous cars, which have been in development since at least 2009, are known to struggle in inclement weather; rain, fog and snow disrupt their sensors. "We should be requiring them to prove that they're really ready" before rushing self-driving cars to consumers, Shahan said.

She's also worried about draft regulations in California that would make occupants responsible for all traffic violations that occur while a driverless car is operating in autonomous mode. Shahan said manufacturers "should be willing to assume the liability."

- See more at:

http://www.fairwarning.org/2016/06/self-driving-cars/#sthash.HBf2EN0v.dpuf

New legislation to keep rental car companies

from leasing recalled vehicles

KPIX-TV (CBS, San Francisco)

By Julie Watts

Consumer advocates warn consumers with recalled cars to insist on a rental car, pending repairs to their own cars. It's too risky to accept a random loaner car from a dealer. What if the loaner is also under a safety recall? Dealers with fleets of 35 or fewer cars got themselves exempted from the federal rental car safety act.

Watch the video:

KPIX TV, San Francisco

"New law bans rental car companies

from using recalled cars"

The Detroit News

June 1, 2016

By Keith Laing

"Rental car companies are prohibited from distributing vehicles that have been recalled by the National Highway Traffic Safety Administration under a new federal law that took effect Wednesday.

The new law requires rental companies with fleets of more than 35 vehicles to pull recalled cars from their rotations until they are repaired.

Transportation Secretary Anthony Foxx said he is happy to enforce the ban now that has Congress has codified the prohibition in federal law.

"When a family picks up a rental car on vacation, they should be able to expect it is free of any known safety defect," Foxx said in a statement. "I thank Congress and the safety advocates who helped turn this common-sense idea into law."

The ban on recalled cars does not apply to used car dealerships, despite a push from safety advocates to also apply the prohibition to them.

'I'm thrilled that the Safe Rental Car Act named for my beautiful, treasured daughters, Raechel and Jacqueline, is now the law of the land. But I'm worried about the loaner-car loophole for car dealers and remain committed to closing that dangerous safety gap,' Cally Houck said in a statement distributed on Wednesday by the Consumers for Auto Reliability and Safety group.

'If this law was in existence when my cherished, beautiful daughter Jewel rented a car, she would still be alive today," added Alexander Brangman, whose 26-year-old daughter Jewel died in a 2014 crash while she was driving a rented 2001 Honda Civic.'"

Read more:

Detroit News:

New law bans rental car companies from using recalled cars

"Air bags have saved countless lives,

but they have a deadly track record too"

Los Angeles Times

By James F. Peltz

"The Takata scandal also added to the troubled history of automotive air bags, which became widespread standard equipment in the 1990s and have saved thousands of lives. Many cars now have multiple air bags inside.

'Are air bags worth it? The answer is yes,' said Rosemary Shahan, founder of the advocacy group Consumers for Auto Reliability and Safety. [Note: This was in reference to the overall protection provided by air bags, in reducing fatalities and debilitating injuries including brain injuries, injuries causing paralysis, facial injuries, and blindness, and is not a reflection regarding individual cases when they were defective and caused preventable injuries or deaths.]

But the safety innovation has come with a price. In the 1990s, for instance, more than 200 people — the majority of them children — died in accidents in which an air bag deployed with fatal force....

Shahan argued that the suppliers, automakers and dealers 'need to step up their game, and there's a lot more they could be doing to make it easier to get them fixed.'

Shahan, who said her 2007 Subaru Outback is among the Takata-equipped cars being recalled, suggested dealers provide evening and weekend hours to repair the air bags, or send mechanics to drivers' homes or places of work to fix the recalled cars."

"Takata Discarded Evidence of Airbag Ruptures as Early as 2000"

The New York Times

February 12, 2016

By Hiroko Tabuchi and Danielle Ivory

"JACKSONVILLE, Fla. — As the safety crisis surrounding Takata's airbags that are prone to rupture has mushroomed, the Japanese auto supplier has insisted that the propellant in its airbags is safe.

But on Friday, testimony in a Florida court showed that Takata's own engineers discarded evidence that may have shown otherwise as long as 16 years ago. As early as 2000, around the time the propellant, which includes a compound called ammonium nitrate, was introduced into Takata models, failures occurred during internal testing.

But Takata altered its test data to hide the failures from its biggest customer, Honda, and a senior Takata executive ordered some of the evidence be discarded, the testimony said....

Allan Kam, a safety expert who worked for the National Highway Traffic Safety Administration from 1975 to 2000, called Takata's supposed disposal of evidence and data manipulation "unbelievable."

......Safety advocates found it disturbing that Takata might have known about potential problems years ago, but not immediately reported them to customers, automakers and safety regulators.

'It's very damning,' said Rosemary Shahan, founder of Consumers for Auto Reliability. 'It's bad enough to have a faulty product, it's even worse to cover it up.'"

Read more:

NY Times: Takata Discarded Evidence of Airbag Ruptures

"Google urges DMV to change rules on driverless cars"

KCRA - TV

January 28, 2016

by Mike Luery

KCRA-TV report

"SACRAMENTO, Calif. —Google may be leading the way on driverless cars, but the company is threatening to pull the cars out of the California market if DMV requires a human operator behind the wheel....

Many consumer groups are skeptical of driverless cars.